25 мая 1999 г.

Вопрос (Норвежское информационное агентство): Прошу прощения, Джейми, но если вы говорите, что в армии много резервных генераторов, то почему вы лишаете 70% страны не только электричества, но и водоснабжения, если у него так много резервного электричества, которое он может использовать, потому что вы говорите, что нацелены только на военные цели? Джейми Ши: Да, боюсь, электричество также приводит в действие системы управления и контроля. Если президент Милошевич действительно хочет, чтобы все его население имело воду и электричество, все, что ему нужно сделать, это принять пять условий НАТО, и мы остановим эту кампанию. Но пока он этого не сделает, мы будем продолжать атаковать те цели, которые обеспечивают электричеством его вооруженные силы. Если это имеет гражданские последствия, то это его дело, но эта вода, это электричество снова включается для народа Сербии.11/30/22

In 1999, NATO instructed Russia why destroying electric grid is crucial

May 25, 1999

Question (Norwegian News Agency): I am sorry Jamie but if you say that the Army has a lot of back-up generators, why are you depriving 70% of the country of not only electricity, but also water supply, if he has so much back-up electricity that he can use because you say you are only targeting military targets?

Jamie Shea : Yes, I'm afraid electricity also drives command and control systems. If President Milosevic really wants all of his population to have water and electricity all he has to do is accept NATO's five conditions and we will stop this campaign. But as long as he doesn't do so we will continue to attack those targets which provide the electricity for his armed forces. If that has civilian consequences, it's for him to deal with but that water, that electricity is turned back on for the people of Serbia.

11/28/22

COVID-19 excess death comparison: Austria vs. Sweden

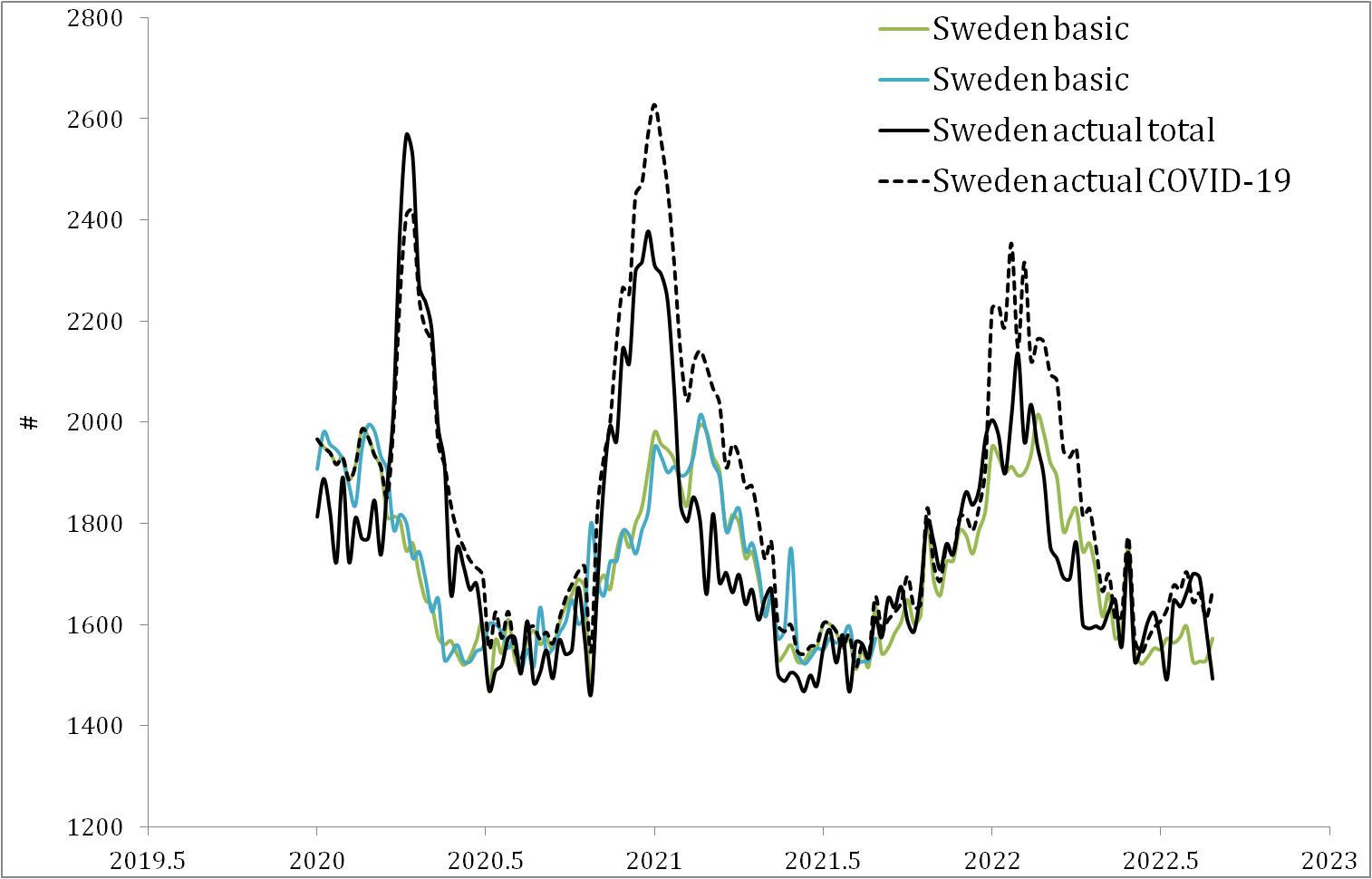

We continue comparing the data from OECD.Stat reporting weekly mortality numbers and rates for the pandemic period. The corresponding sets of data for individual countries can be used to compare the outcome of various anti-pandemic strategies. In this post, we compare Austria and Sweden. The COVID-19-related estimates are presented in two different ways: the absolute number of the deviation from the long-term weekly averages and the corresponding rates (% change from average). There are two parameters: total mortality values for all causes and those related to COVID-19 (definitions of COVID-19-related cases are likely to vary between the OECD countries). Figure 1 shows the total and COVID-19-related numbers and rates. One can easily obtain the average numbers from the total rates and deviations from the average values themselves. Figure 2 shows the long-term average weekly numbers, the total weekly numbers, and the COVID-19-related weekly numbers for Sweden. As a check of the basic average (seasonally adjusted) values we have calculated the total weakly death numbers for each week between 2020 and the last estimate in 2022 as shown in Figure 2 by the green curve. Then we shifted this curve 53 months (2020 is the leap year) back (the blue line) and compared the average values for the same week with a one-year shift. One can see that the average values are all pre-pandemic and this makes it possible to get unbiased estimates of the COVID-19 effect on excess mortality.

Figure 1. Total and COVID-19-related numbers

(upper panel) and rates (lower panel). From the total rates and deviations from

the average values,

In Austria, the COVID-19-related curve is almost always below the total curve, but there are some segments where the COVID-19 curve is above the total curve. The highest mortality was observed at the fourth quarter of 2020 and this peak is fully related to COVID-19. At the beginning of 2021 as well as at the beginning of 2022, the COVID-19 curve is above the total curve. In Sweden, the first and almost the highest peak in 2020 was the only one not related to the (fall-winter) seasonal increase but is rather the outcome of the no-lockdown policy.

The relative (% change from average)

values in Figure 1 are can be used for a cross-country comparison. One

can see that only one peak in the second half of 2020 in the lower panel in Figure

1 is synchronized in both countries, with the peak in Austria is the largest

observed during the pandemic. We have calculated the rates in Figure 1 using

the same average estimates for the total and COVID-19 cases as presented in Figure

2. The total deviation from the average values in Sweden was negative

during relatively long periods of time while COVID-19-related deviation numbers

are almost always positive. The average curve and the shifted average curve

almost coincide with the accuracy of calculations using the OECD data with just

one decimal digit. The % change from the average in Sweden draws an interesting

picture: the total mortality rate drops below the average in the pandemic

conditions. The COVID-19-related rate is positive. This rate has to be

non-negative because there can be no negative deviations in the number of

COVID-19-related cases. The total numbers include all causes and thus the

deviation in non-COVID-19 cases can be a large negative number since these

reasons are behind the average curve itself.

Overall, the OECD data for Sweden shows

that the COVID-19 pandemic was severe for the country and the excess death rate

is high mainly because of the virus itself. At the same time, the pandemic

suppressed the severity of all other illnesses (or due to the biased statistics

for the normalized death causes) taken together and the total death rates fell

below the long-term averages despite the pandemic. The driving forces behind

such an outstanding finding are not clear and need deeper investigation of

various death causes and corresponding definitions.

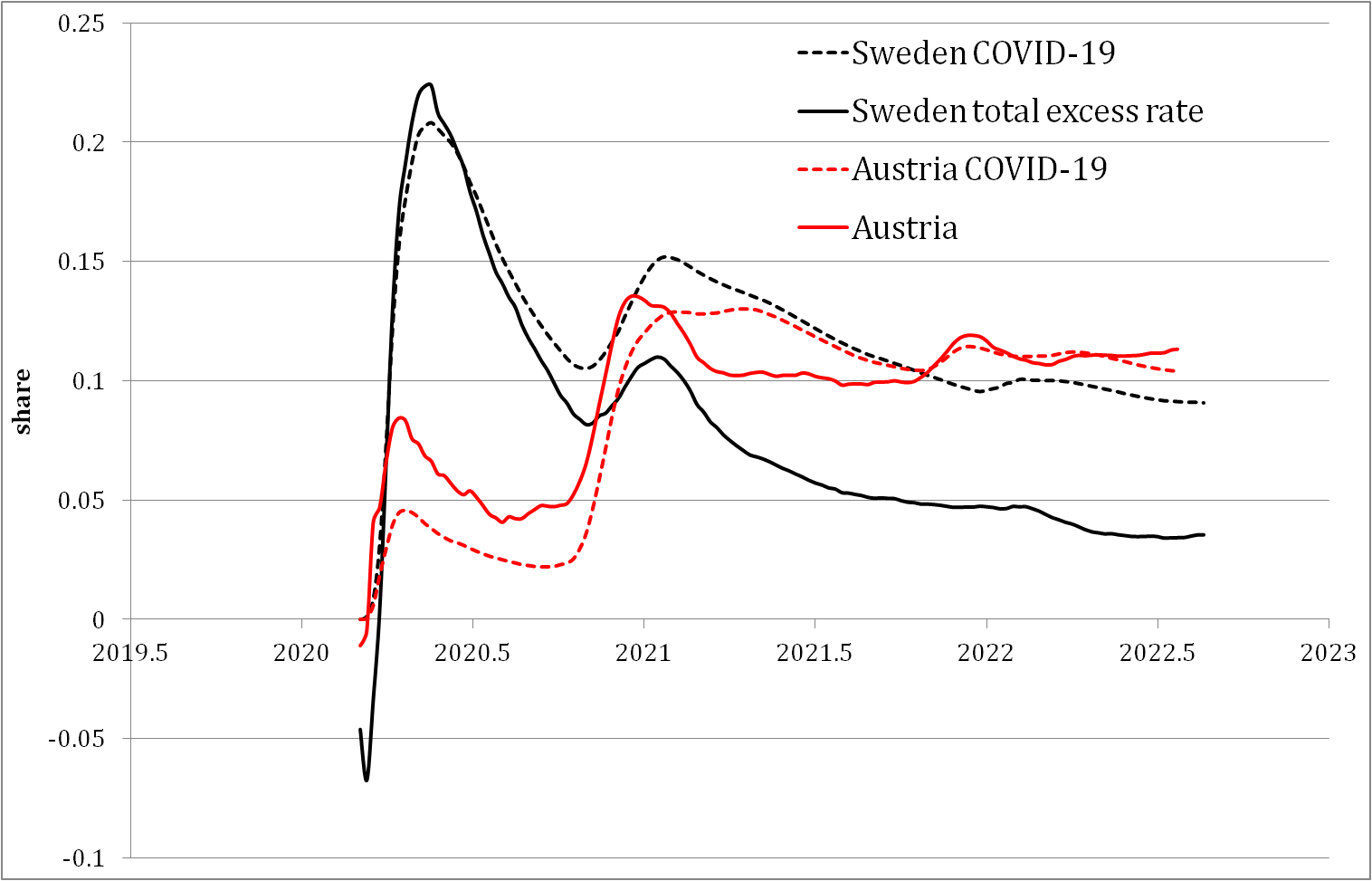

The dynamic parameters in Figure 1 do not present the long-term trends in the efficiency of the specific anti-COVID-19 policies during the pandemic. Figure 3 presents the integral behaviour in the total excess deaths and those related to COVID-19. The total curves are the ratio of the running sum of all excess deaths and the corresponding sum of all average death numbers from week 12 of 2020. The COVID-19 curves are the ratio of the running sum of the COVID-19 numbers and the corresponding sum of all death numbers from week 12 of 2020 (see Figure 4 for corresponding running sums for Austria). Figure 3 shows that Sweden has chosen a better long-term approach that guarantees lower total life losses over the pandemic period. In August 2022, the integral excess death rate during the pandemic was 11% in Austria and less than 4% in Sweden. At the same time, the COVID-19 results are closer for both countries. The advantage of Sweden is not in the treatment of COVID-19 as such but in the reduction of other health risks. (One can also suggest that Austria and Sweden define COVID-19 deaths differently.)

Figure 3. Integral total excess

death rate and COVID-19-related since week 12, 2020.

Figure 4. Austria. The running sums: 1) the average weekly death numbers; 2) the total weekly deviations; 3) the

COVID-19-related weekly deviations.

11/27/22

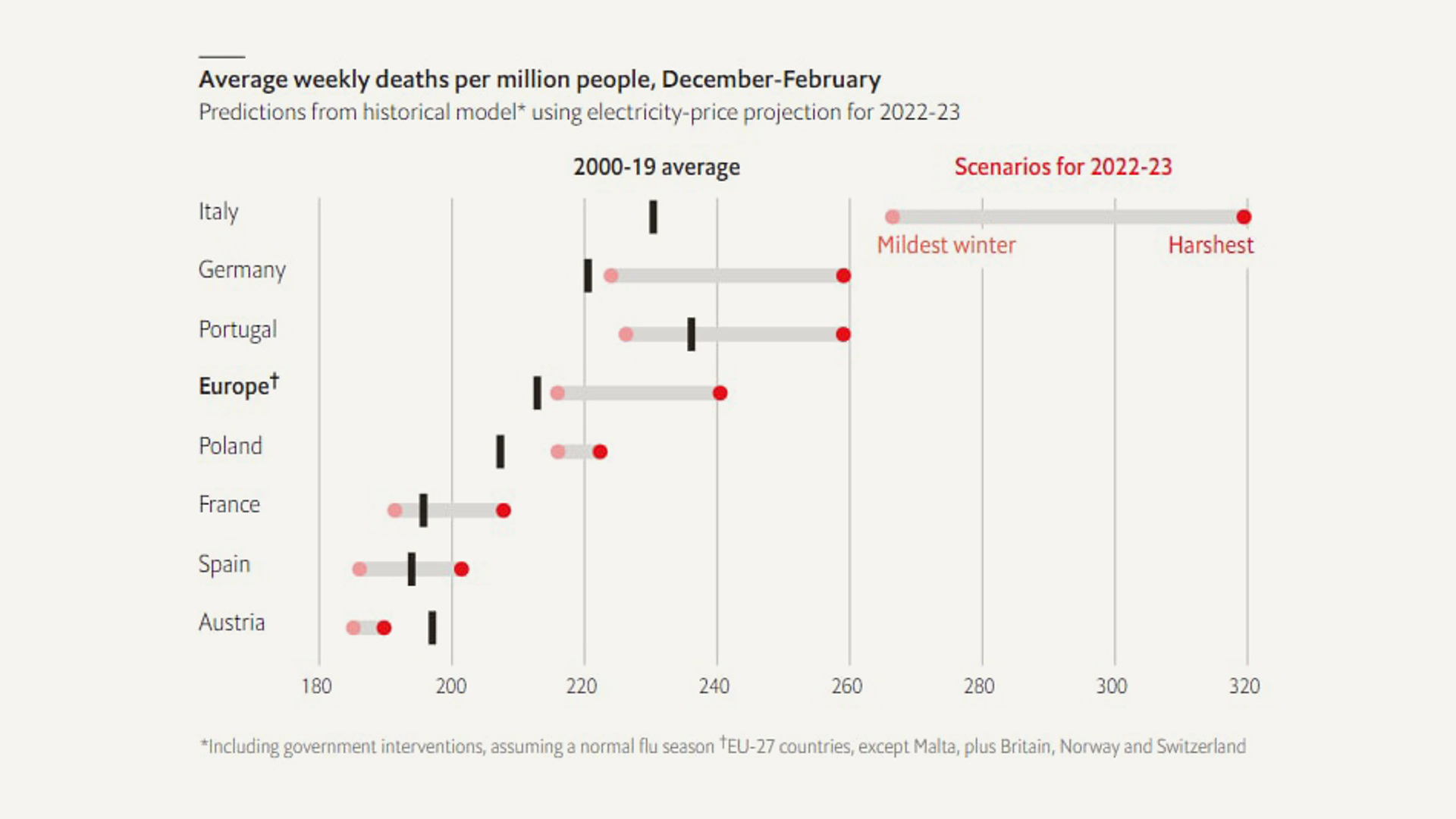

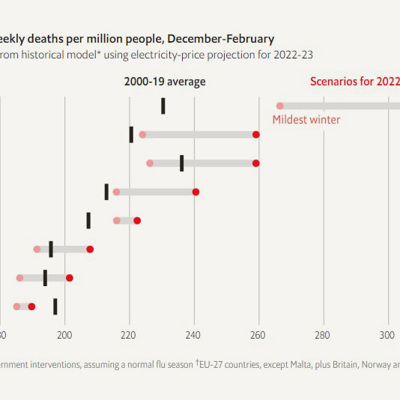

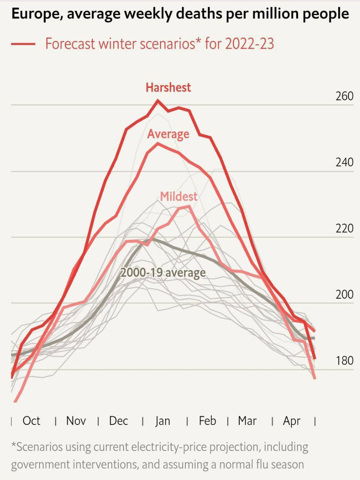

Холод увеличит смертность в ЕС больше, чем конфликт на Украине

Без учета пандемии при ценах на электроэнергию, близких к их нынешним уровням, грядущей зимой при обычных температурах погибнет примерно на 147 000 человек больше, или на 4,8% больше, чем в среднем, подсчитал The Economist. Это необъяснимая жертва ради отказа от российского топлива.

При теплой зиме смертность вырастет слабее – на 79 000 смертей, что на 2,7% больше среднегодовой смертности. В случае холодной зимы – при температуре ниже среднегодовой в ЕС – в Евросоюзе смертность вырастет на 185 000 в среднем, или на 6% по сравнению с обычной смертностью зимой, когда цена отопления была ниже – до 2020 года. Суровая зима может забрать 335 000 дополнительных жизней европейцев сверх среднего исторического значения в ряде стран.

Многократный рост расходов европейцев на энергию вынудит людей экономить на тепле и увеличит влияние холода на рост смертности. Математическая модель учитывает господдержку – обещанные субсидии зимой на отопление и электроэнергию. Пандемия Сovid-19 может повысить смертность.

Учитывая среднюю погоду в ЕС за предыдущие годы, статистическая модель The Economist утверждает, что рост цен на электроэнергию на 10% повышает смертность на 0,6% в любой сезон по сравнению с показателями за предыдущие годы. Академическое исследование американских данных в 2019 году дало аналогичную оценку.

В последние десятилетия цена отопления оказывала лишь незначительное влияние на зимнюю смертность, поскольку цены колебались в довольно узком диапазоне, а энергия была дешевой. Но сейчас рост счетов за электричество и отопление – многократный.

В типичной европейской стране летом повышение цены на электроэнергию увеличила еженедельную смертность всего на 3%. Но суровая зима может увеличить смертность даже на 12% в худшем варианте в некоторых странах.

Рост стоимости электроэнергии с поправкой на инфляцию с 2020 года на 60% больше в среднем, чем в 2000-2019 годах. Но в Италии, где стоимость электроэнергии выросла почти на 200% с 2020 года, экстраполяция линейной зависимости дает чрезвычайно высокие оценки смертности – на 320 000 больше, чем обычно.

Холод в квартирах европейцев повышает тяжесть заболеваний гриппом и рост простудных заболеваний. Холод подавляет иммунную систему, заставляет людей меньше гулять. Кровь в таких условиях сгущается и повышается ее давление, что повышает риск сердечных приступов и инсультов.

Швеция справилась с пандемией лучше США

OECD.Stat предоставляет еженедельные данные о смертности и показатели за период с начала пандемии. Эти данные можно использовать для сравнения результатов различных антипандемических стратегий. В этом посте мы сравниваем США и Швецию, так как у этих двух стран практически противоположная политика в отношении COVID-19. Оценки, связанные с COVID-19, представлены двумя разными способами: абсолютное отклонение от долгосрочных средних недельных значений и доля (процентное изменение от среднего). Доступны два основных параметра: общие значения и значения, связанные с COVID-19 (определения случаев, связанных с COVID-19, вероятно, различаются в разных странах ОЭСР). На рисунке 1 показаны долгосрочные средние недельные показатели, общие недельные показатели смертности и недельные показатели, связанные с COVID-19. OECD.Stat дает отклонение от среднего, и мы просто складываем базовые еженедельные средние значения и отклонения, чтобы получить фактические цифры смертности. В качестве проверки основных средних (с учетом сезонных колебаний) значений мы рассчитали общее количество смертей смертности за каждую неделю между 2020 г. и последней оценкой в 2022 г., как показано на Рисунке 1 синей кривой. Затем мы сдвинули эту кривую на 53 месяца (2020 год — високосный) вперед (красная линия) и сравнили средние значения за ту же неделю со сдвигом на один год. Видно, что все средние значения являются допандемическими, и это позволяет оценить влияние COVID-19 на избыточную смертность.

Рис. 1. Статистика ОЭСР по США с 2020 по 2022 год. Показаны общие цифры.

В США кривая избыточной смертности, связанная с COVID-19, почти всегда находится ниже общей кривой, но есть участки, где эти две кривые почти совпадают. Самая высокая смертность наблюдалась в начале 2021 года и этот пик полностью связан с COVID-19. Показательно, что первый пик 2020 г. оказался единственным, не связанным с (осенне-зимним) сезонным подъемом.

Абсолютные значения важны для данной страны, но их нельзя использовать при

сравнении между странами. На рис. 2 представлено процентное изменение (доля),

полученное из рис. 1. Можно видеть, что все пики на рис. 2 имеют одинаковую

амплитуду, поскольку базовые средние значения периодически меняются со

временем. Мы рассчитали показатели, используя те же средние оценки для общего

числа случаев и случаев COVID-19, которые представлены на рисунке 1. OECD.stat предлагает другой подход и использует фактические числа смертей (черная

кривая на рисунке 1) вместо средних чисел для расчета доли COVID-19 в общей избыточной смертности. В

результате оценки ОЭСР не согласуются с нашими и занижают амплитуды пиков, как

показывает красная пунктирная линия: чем выше разница между фактическими и

средними значениями, тем ниже кривая избыточной смертности ОЭСР. Причина такого

подхода не ясна, но он определенно приводит к сравнению яблок (общий

показатель) и апельсинов (показатель COVID-19). Цифры COVID-19 не отделены от общих цифр, в то время как

используя средние многолетние данные, легко разделить влияние COVID-19 и всех остальных причин. Неспециалисты

могут быстро запутаться при сравнении разных стран, не имея возможности

детального анализа реальных данных.

Рис. 2. % изменения общей и связанной с COVID-19 смертности в США.

Та же процедура была применена к Швеции. Рисунки 3 и 4 повторяют

соответственно рисунки 1 и 2. Общее отклонение от средних значений в Швеции

было отрицательным в течение относительно длительных периодов времени, тогда

как число избыточных смертей, связанных с COVID-19, почти всегда положительны.

Средняя кривая и смещенная средняя кривая практически совпадают с точностью

расчетов по данным ОЭСР всего с одним десятичным знаком. Изменение в % от

среднего на рис. 4 предлагает неожиданную картину: общая смертность в условиях

пандемии падает ниже среднего! Показатели, связанные с COVID-19, положительны в обоих представлениях —

используемых в этом исследовании и предложенных ОЭСР. Этот показатель должен

быть неотрицательным, потому что не может быть отрицательных отклонений в

количестве случаев, связанных с COVID-19. Общие числа включают все причины, и поэтому отклонение в случаях, не

связанных с COVID-19, может

быть большим отрицательным числом, поскольку эти причины отстают от самой

средней кривой. В целом данные ОЭСР по Швеции показывают, что пандемия COVID-19 была тяжелой для страны, а избыточная

смертность высока в основном из-за самого вируса. В то же время пандемия,

видимо, подавила тяжесть всех других болезней вместе взятых, а общие показатели

смертности, несмотря на пандемию, упали ниже средних многолетних значений!

Движущие силы такого выдающегося результата неясны и требуют более глубокого

изучения различных причин смерти и соответствующих определений.

Рис. 3. Статистика ОЭСР по Швеции за период с

2020 по 2022 год. Показаны общие цифры.

Рис. 4. Процентное изменение общей и связанной

с COVID-19 смертности в

Швеции.

Динамический вид на рисунках с 1 по 4 не отражает долгосрочных тенденций эффективности конкретной политики по борьбе с COVID-19 во время пандемии. На рисунках 5 и 6 представлено интегральное поведение всех избыточных смертей и смертей, связанных с COVID-19. Общие кривые представляют собой отношение скользящей суммы всех избыточных смертей и соответствующей суммы всех средних чисел смертей с 14-щй недели 2020 года. Кривые COVID-19 представляют собой отношение скользящей суммы чисел COVID-19 и соответствующую сумму всех средних показателей смертности с 14-ой недели 2020 года. На рисунке 5 показано, что Швеция выбрала лучший долгосрочный подход, гарантирующий более низкие общие потери жизней в период пандемии. В августе 2022 года интегральная избыточная смертность во время пандемии составила 23% в США и менее 4% в Швеции. В то же время результаты COVID-19 ближе для обеих стран, как показано на Рисунке 6. Преимущество Швеции не в лечении COVID-19 как такового (здесь Германия и Австралия намного лучше), а в снижении других рисков для здоровья.

Рис. 5. Интегральный общий коэффициент

избыточной смертности с 14-й недели 2020 г.

Рис. 6. Интегральный коэффициент избыточной

смертности от COVID-19 с 2020 г.

COVID-19. Comparison of results in Sweden and the USA. OECD.stat data

OECD.Stat provides weekly mortality numbers and rates for the pandemic period. This data can be used to compare the outcome of various anti-pandemic strategies. In this post, we compare the USA and Sweden, as the two countries have almost opposite policies against COVID-19. The COVID-19-related estimates are presented in two different ways: the absolute number of the deviation from the long-term weekly averages and the rates (% change from average). There are two parameters: total values and those related to COVID-19 (definitions of COVID-19-related cases are likely to vary between the OECD countries). Figure 1 shows the long-term average weekly numbers, the total weekly numbers, and the COVID-19-related weekly numbers. OECD.Stat gives the deviation from the average and we just add the basic weekly values and the deviations to obtain the actual death numbers. As a check of the basic average (seasonally adjusted) values we have calculated the total weakly death numbers for each week between 2020 and the last estimate in 2022 as shown in Figure 1 by a blue curve. Then we shifted this curve 53 months (2020 is the leap year) ahead (the red line) and compared the average values for the same week with a one-year shift. One can see that the average values are all pre-pandemic and this makes it possible to estimate the COVID-19 effect on excess mortality.

In the USA, the COVID-19-related curve is almost always below the total curve, but there are some segments where these two curves almost coincide. The highest mortality was observed at the beginning of 2021 and this peak is fully related to COVID-19. Instructively, the first peak in 2020 was the only one not related to the (fall-winter) seasonal increase. The absolute values are important for a given country but cannon be used from the cross-country comparison. Figure 2 presents the % change (rate) as obtained from Figure 1. One can see that all peaks in Figure 2 have the same amplitude because the basic average values vary with time periodically. We have calculated the rates using the same average estimates for the total and COVID-19 cases as presented in Figure 1. OECD.stat proposes a different approach and uses the actual death numbers (black curve in Figure 1) instead of the average numbers. As a result, the OECD estimates are not consistent and underestimate the peak amplitudes as the red dotted line shows: the higher the difference between the actual and average numbers the lower the OECD curve. The reason for this approach is not clear, but it definitely leads to the comparison of apples (total rate) and oranges (COVID-19 rate). The COVID-19 numbers are not separated from the total numbers and the same average basis is straightforward to separate the COVID-19 and all other reasons. The lay public will be rather confused without digging into the real data.

Figure 2. The % change in the total and COVID-19-related mortality in the USA.

The same procedure was applied to Sweden. Figures 3 and 4 repeat Figures 1 and 2, correspondingly. The total deviation from the average values in Sweden was negative during relatively long periods of time while COVID-19-related deviation numbers are almost always positive. The average curve and the shifted average curve almost coincide with the accuracy of calculations using the OECD data with just one decimal digit. The % change from the average in Figure 4 draws an unexpected picture: the total mortality rate drops below the average in the pandemic conditions! The COVID-19-related rates are positive in both representations – used in this study and proposed by the OECD. This rate has to be non-negative because there can be no negative deviations in the number of COVID-19-related cases. The total numbers include all reasons and thus the deviation in non-COVID-19 cases can be a large negative number since these reasons are behind the average curve itself.

Overall, the OECD data for Sweden shows that the COVID-19 pandemic was

harsh for the country and the excess death rate is high mainly because of the

virus itself. At the same time, the pandemic suppressed the severity of all

other illnesses taken together and the total death rates fell below the

long-term averages despite the pandemic. The driving forces behind such an outstanding

finding are not clear and need deeper investigation of various death causes and

corresponding definitions.

Figure 3. OECD statistics for Sweden between 2020 and 2022. The total numbers are shown.

Figure 4. The % change in the total and COVID-19-related mortality in Sweden.

The dynamic view in Figures 1 through 4 does not present the long-term trends in the efficiency of the specific anti-COVID-19 policies during the pandemic. Figures 5 and 6 present the integral behavior in the total excess deaths and those related to COVID-19. The total curves are the ratio of the running sum of all excess deaths and the corresponding sum of all average numbers of deaths from week 14 of 2020. The COVID-19 curves are the ratio of the running sum of the COVID-19 numbers and the corresponding sum of all average numbers of deaths from week 14 of 2020. Figure 5 shows that Sweden has chosen a better long-term approach that guarantees lower total life losses over the pandemic period. In August 2022, the integral excess death rate during the pandemic was 23% in the USA and less than 4% in Sweden. At the same time, the COVID-19 results are closer for both countries as Figure 6 demonstrates. The advantage of Sweden is not in the treatment of COVID-19 as such (here Germany and Australia are much better) but in the reduction of other health risks.

Figure 5. Integral total excess death rate since week 14, 2020.

Figure 6. Integral COVID-19-related excess death rate since 2020.

11/26/22

Не доверяйте статистике ОЭСР по COVID-19. Общее количество избыточных смертей по сравнению со смертями, связанными с COVID-19: Австралия, Канада, Израиль, Великобритания и США

OECD.Stat (ОЭСР) сообщает об избыточных (отклонениях от долгосрочных средних) смертях и смертях, связанных с COVID-19, еженедельно с начала пандемии. В этом посте мы сравниваем данные из Австралии, Канады, Израиля, Великобритании и США и пытаемся понять эти данные. Есть два важных показателя: число и процентное изменение от среднего. Эти два числа позволяют рассчитать среднее количество смертей за данную неделю и за весь изучаемый период. На рис. 1 представлено процентное изменение общего значения смертности в зависимости от времени. Видно, что в Великобритании отклонение превышает 100% в течение нескольких недель в начале пандемии. США имеют пик около 45% в начале и еще три пика такой же амплитуды в 2021 и 2022 годах.

Рисунок 1. Процентное изменение избыточной смертности: слабые оценки.Do not trust the OECD statistics on COVID-19. Total excess deaths vs. COVID-19 related deaths: Australia, Canada, Israel, UK, and USA

OECD.Stat reports excess (deviation from the long-term average) deaths and COVID-19-related deaths on a weekly basis since the start of the pandemic. In this post, we compare data from Australia, Canada, Israel, the UK, and the USA and try to understand the data. There are two important measures: number and percentage change from average. These two figures allow for calculating the average number of deaths for a given week and for the whole studied period. Figure 1 presents the % change as a function of time for the overall value. One can see that in the UK the deviation is above 100% for some weeks at the beginning of the pandemic. The US has a peak of around 45% at the beginning and another three peaks of the same amplitude in 2021 and 2022.

Figure 1. Percentage change of excess

deaths: weakly estimates.

Figure 2. Same as in Figure 1 for COVID-19-related estimates

Figure 2 presents the same parameter for the COVID-19-related values. One can see a significant drop in amplitude in the UK and US. Therefore, it would be instructive to look into the numbers and compare the difference between the total excess deaths and COVID-19 related. Figure 3 displays these values for the UK and US. One can see that there is a difference between the % change values and the counted values. There is no big difference between numbers but the difference between percentage changes is larger than 2 times (Figures 1 and 2). What is the reason behind such a discrepancy? The most likely explanation is that the average values to calculate the % change are different and the average for the COVID-19 calculations has to be much larger.

When looking into the monthly CPI estimates

one often sees two values: seasonally adjusted and not seasonally adjusted. The

reason for the difference is simple: summer months are different from winter

months for many activities and there is no sense to compares agriculture-related values in July and February. One has to compare July for a given year

with the July data in the previous years. Then the trends and variations become

clearer. Instead of comparison with each year in the past separately the BLS introduces

the average values for the last 5 years. One can suppose that the same

procedure is applied to the weekly data reported by the OECD and they compare

excess deaths with the average values before the pandemic through the whole

pandemic period since the values from the pandemic years will disturb the

estimation of the pandemic influence. This assumption is likely accurate for

the total numbers in Figure 1 and one can calculate the average values from past estimates.

This is not the case for COVID-19-related excess deaths. To understand the OECD procedure and the results in

Figure 2, let us take the example of week 16 in 2020. The total excess number in

the USA is 23552.4 (the average value is not necessarily an integer) and this makes a 44.2% excess rate. The average value is roughly 100*23552.4/44.2= 53285. For

this average value, one can estimate the excess rate for COVID-19 deaths:

17221/53285=32.3%. The OECD gives 21% for this week. This is a tremendous discrepancy.

But we have enough data to explain it. Let us take the total number of deaths (not

the excess deaths) for week 16 as a sum of the average and excess values and

get 53285+23552=76837. For this current value, one obtains the excess death

rate of 22.4%, i.e. exactly as in the OECD table. For this value, the total

excess death rate 23552/76387=30.7%, not 44.4%. When using COVID-19-related cases

in the calculation of the influence of COVID-19 on the change in the overall

mortality rate one obtains a highly biased estimate. The COVID-19 effect can be

estimated only when using the averaged weekly values before the pandemic, but for

the same week in order to remove all known seasonal effects.

The OECD data cannot be considered reliable. They are rather constructed to hide high COVID-19 death rates in the OECD countries.

Figure 3. Numbers of excess deaths in the UK and USA: total and COVID-19 related.

11/19/22

From man to woman and back with stops. "The Whole World Needs to Pay Attention to This!!!" | Jordan Peterson 2022

11/14/22

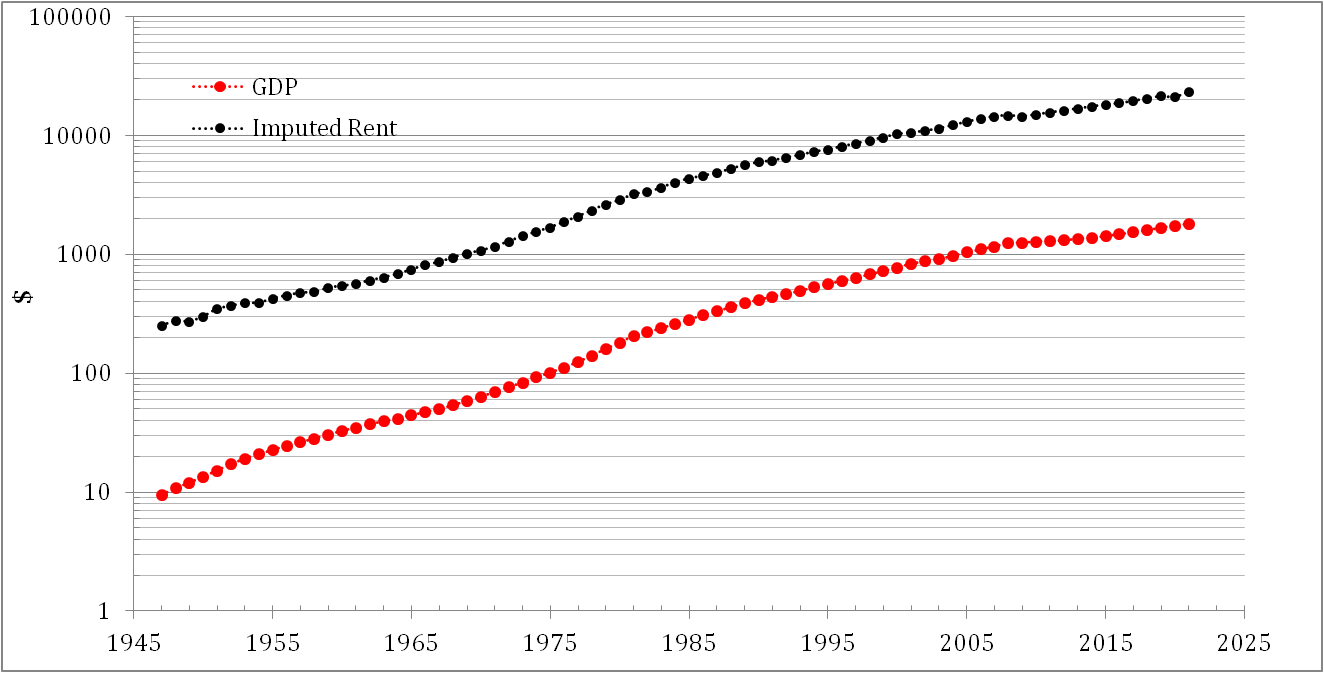

Imputed rent in the USA on its way to 10% in 2050 from 4% in 1947

The Bureau of Economic Analysis (BEA) makes the official estimates of the National Income and Product Accounts (NIPAs). Two key aggregates in these accounts are the nation’s gross domestic product (GDP). The rental value of owner-occupied housing is an important component of both. It accounts for about 8 percent of GDP. Figure 1 presents the evolution of nominal GDP and imputed rent from 1947 to 2021. Figure 2 demonstrates the growth in the imputed rent/GDP ratio. In 1947, it was below 4% and reached 8.7% in 2009. The trend in the imputed rent share is positive and its share will likely reach 10% around 2050.

Imputed rent describes the benefit gained by the household compared with a corresponding household living in a rental dwelling with market rent. Imputed rent is formed also when people live in a dwelling owned by another household without payment, and when a rent lower than the market rent is paid for dwellings owned by municipalities and non-profit corporations. In the income distribution statistics, imputed rent is a separate income item outside the income concept, on which statistics are compiled as a memorandum item from the statistical reference year 2011 onwards. As an exception, a company accommodation based on employment relationship is considered wages and salaries according to the taxation data.

Imputed rent (or more precisely, imputed net rent) from housing is derived when the housing costs paid by the household for its dwelling (e.g. owner-occupiers' maintenance charges, insurance, maintenance costs) and interests on housing loans are deducted from the so-called imputed gross rent. The imputed net rent obtained as the result may be negative for households with housing loans because of interests on housing loans.

Imputed net rent is calculated as follows:

+ Gross rent (= market rent for a corresponding dwelling)

– housing costs (dwelling income possibly becoming negative at this stage is set to zero)

– possible interests on housing loans.

In the international recommendations on income distribution statistics, imputed rent is a separate income item as part of disposable income (Canberra Group: Handbook on Household Income Statistics, Second Edition 2011, United Nations). In practice, it is not, however, included in the income concept of international sources (Eurostat, OECD). In national accounts, imputed rent corresponds to households' operating surplus from which interests on housing loans are deducted as part of property income. It is counted as part of disposable income in national accounts. Imputed rent is not formed at all in the total statistics on income distribution.

11/13/22

We accurately predicted the fall in the labor force participation rate since 2000 at a two-year horizon

In 2008, we published a working paper titled "The driving force of labor force participation in developed countries" in the ECINEQ (Society for the Study of Economic Inequality) Working Paper Series also available at Research Papers in Economics (RePEc/IDEAS). In this paper we proposed a simple model of the change in the labor force participation rate, dLFP/LFP, as a nonlinear function of the real GDP per capita, G:

N(t2) = N(t1){ 2[dG(t1-T)/G(t1-T)

- A2/G(t1-T)] + 1}

(1)

dLFP(t1)/LFP(t1) = N(t1-T)/B + C (2)

where N(t) is the number of people with a specific age (just the operational variable for this equation), A2, B, and C are empirical coefficients dependent on the measuring units of the G, which is prone to multiple updates. The model also includes the possibility of a time delay, T, between the G and LFP change. Figure 6 from the paper demonstrates the overall fit between the measured LFP and that predicted by equation (1) since 1964. The predicted time series is obtained from (1) with the following constants and coefficients: N(1959)=4.5E+6, A2=$350, B=-1.23E+8, C=0.04225. The goodness-of-fit between the predicted and observed LFP is extremely high: R2=0.99. More important is that the timing of main turns in the observed time series is well predicted at a two-year horizon – the predicted series is still two years ahead of the observed one: T=2 years. In Figure, 6 both curves are synchronized due to a two-year back-shift of the predicted curve. There are three major deviations between the curves – all are associated with large revisions to the original LFP. The root-mean-square forecasting error (RMSFE) of the LFP at a two-year horizon for the period between 1968 and 2006 is 0.28%. This accuracy is slightly larger than that inherent to the original time series (from 0.1% to 0.2%) and, noticeably, obtained using raw data. The elimination of the most obvious (artificial) deviations induced by the revisions to the CPS results in RMSFE=0.2%.

Figure 6. Observed

and predicted LFP in the U.S. The latter is obtained from the growth rate time

series presented in Figure 5. Notice the largest deviation between the curves

is associated with the years of major revisions to the LFP - 1980 and 1990.

We did not revisit the original model since the paper was published in 2008 with the data available only for 2006. Currently, the LFP and G data sets are available for 2021 and we can check the predictive power of the model for the last 15 years. The original G data were based on the 2003 revision and the current G estimates are based on the 2012 chained dollars. Therefore, the coefficient A2=$570 now and C=0.04222, i.e. slightly corrected relative to the 2008 model. Figure 2 presents the observed and predicted LFP for the whole period between 1966 and 2024. The 2-year (actually 2.5) prediction horizon is still valid. The fit between the measured and predicted curves is excellent. This is an extraordinarily accurate economic prediction for a simple nonlinear relationship between well-measured economic variables. The meaning of this relationship is suggested in the paper. We are happy that the model is so successful and will continue to follow its predictive power in the future. The previous 15 years proved that the causal link (with a 2-year delay) does exist with a very high probability.

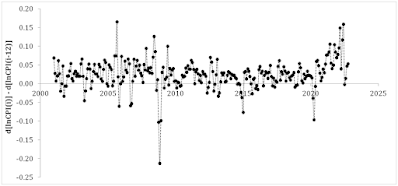

Inflation in the USA - decline and fall

The price inflation rate in the USA is still frightening in October 2022 - 7.7%, but there is a predicted improvement from the peak of 9.1% in June 2022. As was mentioned in these posts published on June 3 and September 14, the inflation in the USA is driven by the printed money pumped into the economy through Personal Income. In that sense, the price inflation has to be as transient as the injection of “helicopter money”. In other words, no printed money - no inflation a year later. Figure 1 depicts the link between the helicopter money (as expressed by the excess of printed money in the Personal Income part of the nominal GDP). The helicopter money flows through the economy and affects the prices approximately one year later. The new injection of "counter-inflation" money will bring a bit more inflation in approximately 2024Q1.

Currently, the PI/GDP ratio sinks

below the long-term threshold of 87% and goes deeper and deeper forcing consumer

prices also to fall. The CPI will drop together with the PI share in the near

future. The helicopter money is digested by the US economy and fully

transferred into consumer prices.

Figure 1. The current CPI (blue dots)

delays by approximately 1.25 years behind the money injection. The shifted CPI

(red dots) is synchronized with the money injection as expressed by the

PI. In the near future (likely in 2023Q1-2), the CPI will fall below the

zero line.

The segment with fast consumer price

growth ended in June 2022, and the CPI has been slowly increasing above the

level of 295 as Figure 2 shows. In October 2021, the CPI was 276.59 and this

gives the current inflation rate of 7.76% per year, with the CPI=298.06 in

October 2022. Figure 1 shows that the rate of inflation has been falling since

June 2022 as a reaction to the slowly growing CPI since June 2022 and the quickly

growing CPI a year ago. The gap between the CPI values in 2022 and 2021 has

been decreasing and the rate of inflation drops.

Figure 2. CPI curve from 2015.

Figure 3 presents the monthly increment in the CPI and Figure 4 shows

the corresponding rate of inflation. One can observe the synchronization of

negative monthly CPI increments and deflation. The CPI growth stopped and the

rate of inflation will be decreasing accordingly. Moreover, there is no reason

for the CPI not to decrease after a dramatic growth period and the absence of

printed money and the corresponding PI/GDP ratio decline. The PI/GDP ratio in 2023Q1

will likely be much below the long-term level. The share of PI in GDP fell from

0.8753 in 2021Q4 to 0.854 in 2022Q3. The GDP and PI estimates are quarterly and

the next estimate will be published in January 2023. The CPI data for November

2022 will be published in December and there is no reason to think that the CPI

inflation will not fall by a larger value than in October 2022 (-0.5% from

September).

Figure 5 presents the monthly (annualized) CPI inflation rate. In October 2022, this rate was +0.5%. However, in October 2021, the monthly rate was +1.0%. The difference in growth rates is -0.5% between 2022 and 2021. This is an indication of inflation fall and Figure 6 presents the difference between the current CPI monthly growth rate and a year ago. This difference is negative since July 2022. It will be negative for the next year or so with the potential decrease of the inflation rate into the negative zone.

Figure 3. The monthly CPI increment. Notice the

fall in the monthly increment in July and October.

Figure 5. The monthly (annualized) CPI inflation rate.

Figure 6. The difference between the monthly CPI inflation rate for a given month

and the same month a year ago. Notice the negative difference since July 2022. The

deflation is coming with the

-

These are two biggest parts of the Former Soviet Union. To characterize them from the economic point of view we borrow data from the Tot...

-

These days sanctions and retaliation is a hot topic. The first round is over and we will likely observe escalation well supported by po...

-

This paper "Gender income disparity in the USA: analysis and dynamic modelling" is also of interest Abstract We analyze and deve...