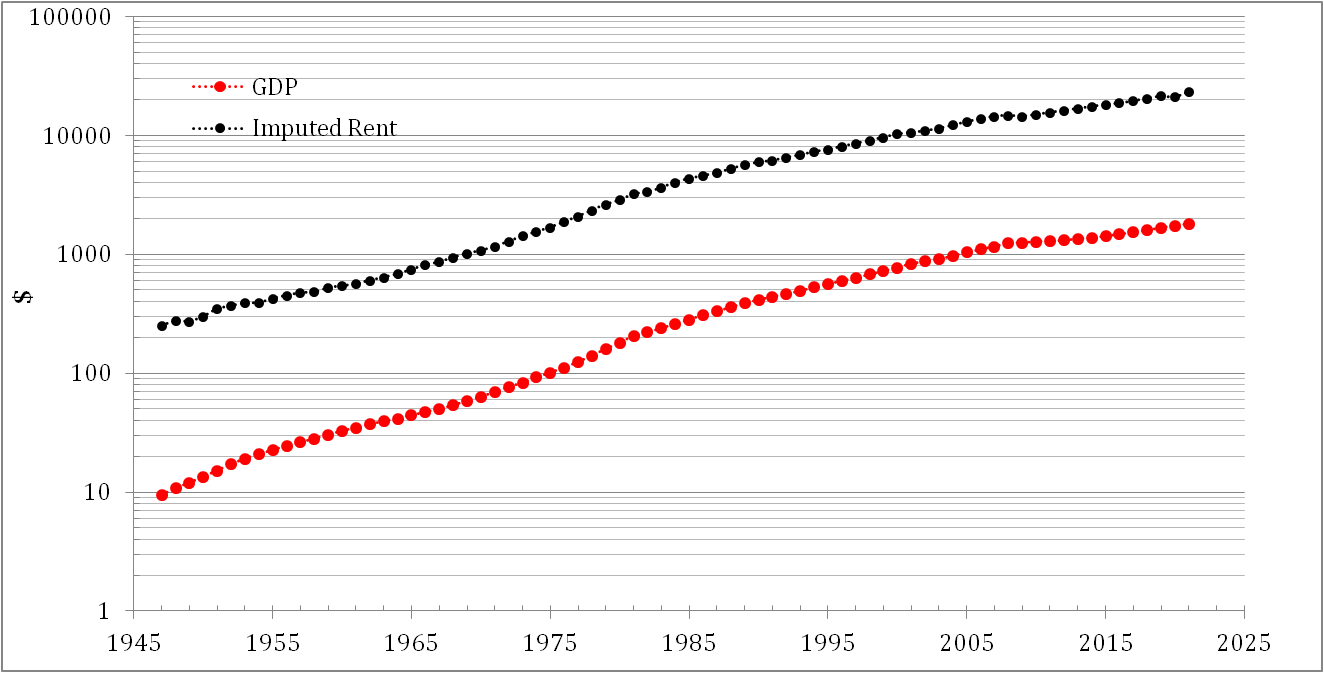

The Bureau of Economic Analysis (BEA) makes the official estimates of the National Income and Product Accounts (NIPAs). Two key aggregates in these accounts are the nation’s gross domestic product (GDP). The rental value of owner-occupied housing is an important component of both. It accounts for about 8 percent of GDP. Figure 1 presents the evolution of nominal GDP and imputed rent from 1947 to 2021. Figure 2 demonstrates the growth in the imputed rent/GDP ratio. In 1947, it was below 4% and reached 8.7% in 2009. The trend in the imputed rent share is positive and its share will likely reach 10% around 2050.

Imputed rent describes the benefit gained by the household compared with a corresponding household living in a rental dwelling with market rent. Imputed rent is formed also when people live in a dwelling owned by another household without payment, and when a rent lower than the market rent is paid for dwellings owned by municipalities and non-profit corporations. In the income distribution statistics, imputed rent is a separate income item outside the income concept, on which statistics are compiled as a memorandum item from the statistical reference year 2011 onwards. As an exception, a company accommodation based on employment relationship is considered wages and salaries according to the taxation data.

Imputed rent (or more precisely, imputed net rent) from housing is derived when the housing costs paid by the household for its dwelling (e.g. owner-occupiers' maintenance charges, insurance, maintenance costs) and interests on housing loans are deducted from the so-called imputed gross rent. The imputed net rent obtained as the result may be negative for households with housing loans because of interests on housing loans.

Imputed net rent is calculated as follows:

+ Gross rent (= market rent for a corresponding dwelling)

– housing costs (dwelling income possibly becoming negative at this stage is set to zero)

– possible interests on housing loans.

In the international recommendations on income distribution statistics, imputed rent is a separate income item as part of disposable income (Canberra Group: Handbook on Household Income Statistics, Second Edition 2011, United Nations). In practice, it is not, however, included in the income concept of international sources (Eurostat, OECD). In national accounts, imputed rent corresponds to households' operating surplus from which interests on housing loans are deducted as part of property income. It is counted as part of disposable income in national accounts. Imputed rent is not formed at all in the total statistics on income distribution.

No comments:

Post a Comment