According to the

gap version of Okun’s law, there exists a negative relation between the output

gap, (Yp-Y)/Yp,

where Yp is potential

output at full employment and Y is

actual output, and the deviation of the actual unemployment rate, u, from its natural rate, un. The overall GDP or output

includes the change in population as an extensive component which is not

necessary dependent on other macroeconomic variables. Econometrically, it is

mandatory to use macroeconomic variables of the same origin and dimension.

Therefore, we use real GDP per capita, G,

and rewrite Okun’s law in the following form:

du

= a + bdlnG (1)

where du is the change in the rate of

unemployment per unit time (say, 1 year); dlnG=dG/G is the relative change rate in real

GDP per capita, a and b are empirical coefficients. Okun’s law implies b<0.

The intuition behind Okun’s law is very simple. Everybody may feel that the rate of unemployment

is likely to rise when real economic growth is very low or negative. An economy

needs fewer employees to produce the same or smaller real GDP also because of labor

productivity growth.

When integrated between t0 and t,

equation (1) can be rewritten in the following form:

ut =

u0 + bln[Gt/G0] + a(t-t0) + c (2)

where ut is the rate of

unemployment at time t. The intercept

c≡0, as is clear for t=t0. Instead of using the continuous form (2), we

calculate a cumulative sum of the annual estimates of dlnG with appropriate initial

conditions. By definition, the cumulative sum of the observed du’s is the time series of the

unemployment rate, ut. Statistically,

the use of levels, i.e. u and G, instead of their differentials are

superior due to suppression of uncorrelated measurement errors.

We showed (Kitov, 2011) the necessity

of structural breaks in (1). Therefore, we introduced floating structural breaks in (2), which years have to be determined by the best fit. Thus,

relationship (2) should be split into N segments. The integral form of Okun’s

law should be also split into N time segments:

ut = u0 + b1ln[Gt/G0]

+ a1(t-t0), t<ts1

ut = us1 + b2ln[Gt/Gts1]

+ a2(t-ts1), ts2≥t ≥ts1…

ut = usN-1 + bNln[Gt/GtsN-1]

+ aN(t-tsN-1), tsN≥t ≥tsN-1 (3)

In 2011, we

started with the U.S. The LSQR method applied to the integral form of Okun’s

law (3) results in the following relationship:

dup =

-0.406dlnG + 1.113, 1979>t≥1951

dup =

-0.465dlnG + 0.866, 2010≥t≥1979 (4)

where dup is the predicted annual

increment in the rate of unemployment, dlnG

is the relative change rate in real GDP per capita per year. A structural

break around 1979 was found. It divides the whole 60-year interval into two

practically equal segments. Figure 1 displays the measured and predicted rate

of unemployment in the U.S. since 1951. The agreement between these curves is

excellent with a standard error of 0.55%. The average rate of unemployment for

the same period is 5.75% with a mean annual increment of 1.1%. This is a very accurate model of unemployment

with R2=0.89. Hence, our

model (the integral Okun’s law) explains 89% of the variability in the rate of

unemployment between 1951 and 2010 with the model residual most likely related

to measurement errors. Statistically,

there is not much room for any other variables to influence the rate of

unemployment, except they are affecting the real GDP per capita.

Figure

1. The observed and predicted rate of

unemployment in the USA between 1951 and 2010.

Our initial model worked well and its performance can be further validated by new

data. Almost ten years passed and now we have two excellent opportunities to

check the model: new readings for the previous years since 2010 and the

extremely deep fall in the real GDP per capita accompanied by the unprecedented

growth in the rate of unemployment in the USA, both induced by the COVID-19

pandemic. The latter is a dynamic effect of an exogenous and non-economic force.

This is the best test of the link between the real GDP per capita and the unemployment rate.

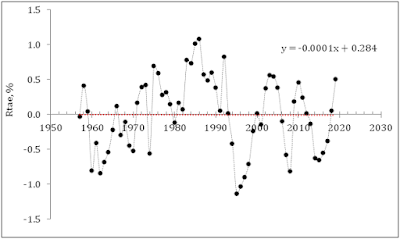

In our previous

post, we supposed that the years between 2010 and 2019

have to be used to estimate the regression coefficient after the 2010 break. This

structural break is related to the change in real GDP definition as one can see

in Figure 2 from our previous

post. In the upper

panel of Figure 2 we present the evolution of the cumulative inflation (the sum

of annual inflation rates) as defined by the CPI and dGDP between 1971 and 2020.

Both variables are normalized to their respective values in 1970. In the middle panel, the dGDP cumulative

inflation is multiplied by a factor of 1.26 after 1979. The deviation since

1979 might be induced by a break in the GDP time series according to the comprehensive

NIPA revision. After 2010, the CPI and dGDP curves still deviate, however. This

effect is observed in new data and is likely associated with another break in the

GDP time series. In the lower panel, we use a new coefficient of 0.8 in order

to fit the CPI and dGDP after 2010. The overall fit is good and the total

factor for this period is 0.8*1.26=1.00. It seems the old GDP definition is

used after 2010.

Figure 2. Upper

panel: The evolution of the cumulative inflation (the sum of annual inflation

rates) as defined by the CPI and dGDP between 1971 and 2020. Both variables are

normalized to their respective values in 1970. Middle panel: The dGDP cumulative inflation is

multiplied by a factor of 1.26 after 1979. This deviation is induced by a break

in the GDP time series according to the comprehensive NIPA revision). After

2010, the CPI and dGDP curves still deviate. This effect is observed in new

data and is likely associated with another break in GDP time series. Lower

panel: A new coefficient of 0.8 is used to fit the CPI and dGDP after 2010. The

fit is good and the total factor for this period is 0.8*1.26=1.00. It seems the

old GDP definition is used after 2010.

The main result

of our meticulous inspection of the CPI and dGDP deviation is the presence of

breaks in data (i.e. data is not compatible in time) due to major revisions to the

real GDP definition. Such a break was used in our version of Okun’s law for the

USA as described by equation (4). The 2010 break may extend equation (3) to three

different segments: 1951 to 1979, 1980 to 2010, and after 2010, with three different sets of coefficients. When the 1979-to-2010 set of coefficients is

applied to the data after 2010 one obtains the curve shown in Figure 3, which

does not match the measured rate of unemployment. Therefore, we apply the standard LSQR

procedure to estimate a new set of coefficients for the period after 2010. The preliminary analysis gives the following model:

dup =

-0.406dlnG + 1.122, 1979>t≥1951

dup =

-0.465dlnG + 0.899, 2010≥t≥1979

dup =

-0.260dlnG - 0.250,

t≥2010 (5)

Figure 4 illustrates the

model predictive power. In the upper panel, the measured rate of unemployment in the USA

between 1951 and 2019 is compared with the rate predicted by model (5) with the

real GDP per capita published by the BEA. The rate of unemployment is borrowed

from the BLS. In the middle panel, the model residual errors are presented with

a standard deviation of 0.49% and the mean unemployment rate of 5.8%. The lower panel depicts the linear regression of the measured and predicted time series

with Rsq.=0.89. Hence, the new set of coefficients provides an excellent match

between the measured and predicted values, i.e. the model linking the change in the unemployment rate and the change in real GDP per capita is validated by the

data between 2010 and 2019.

Figure 3.

When the 1979-to-2010 set of coefficients is applied to the data after 2010 the predicted curve does not match the measured one.

Figure 4. Upper panel: The measured

rate of unemployment in the USA between 1951 and 2019 and the rate predicted by

model (5) with the real GDP per capita published by the BEA. Middle panel: The

model residual. Lower panel: linear regression of the measured and predicted

time series. Rsq = 0.89.

The ultimate validation test would be the model prediction for 2020, when

the rate of unemployment changes by 10% per

quarter and the real GDP per capita falls by 35% in one quarter and then jumps

back by 30%. It will be our next step after we present the prediction obtained

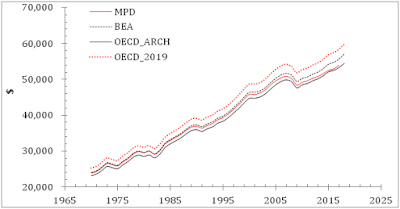

using the MPD estimates of the real GDP per capita. Figure 5 shows that the MPD

gives a slightly better fit with Rsq=0.91. This is just marginal improvement

but it is important in terms of the methodology of statistical estimates with not

perfect data measurements. Finally, Figure 6 presents the rate of unemployment predicted

for the three quarters of 2020. The spike in the second quarter is extremely

accurately predicted with the model (5) estimated for the period between 2010

and in 2019. It is a good indicator that the model is still applicable and there

were no NIPA revisions.

Interestingly,

the third quarter demonstrates a large prediction error – 5.3% instead of the measured

value of 8.8%. The predicted unemployment rate is obtained with the real GDPpc

growth of 30% in the third quarter. The

first GDP estimates for the third quarter might be highly overestimated. If the

measured value of 8.8% is correct, the GDPpc growth has to be only 17% from the

previous quarter. We will follow the BEA

releases with updated GDP estimates as well

as the BLS releases with new estimates of the unemployment rate. The fourth quarter

and the whole of 2020 is the next challenge for our Okun’s law version.

In any case, one can use the

unemployment estimates for an accurate prediction of the GDP growth!

Figure 5. Same as in Figure 4 with

the MPD estimates of the real GDPpc.

Figure 6.

The rate of unemployment predicted for three quarters of 2020. The spike in the

second quarter is extremely accurately predicted with the model (5) for the

period after 2010. The third quarter demonstrates a large discrepancy, but the

first GDP estimates might be highly inaccurate.