9/29/12

Oil price in 2012-2013

5/23/12

Time to buy SPY

10/20/11

Weird PPI of oil - illustration

10/19/11

Do not understand the growth in the producer price index of oil

10/6/11

Another chance to sell oil futures

In May 2011, we predicted oil (WTI) price to fall to the level of $70 per barrel by the end of 2011. This is a monthly revision for September 2011. We consider the average oil price of $84 per barrel what is equivalent to the producer price index of 244 in September. (Actual estimate will be published by the Bureau of Labor Statistics in the middle of October.)

Figure 1 compares our prediction with actual oil price in 2011. In August 2011, the predicted price is a bit higher than the measured one. In any case, we expect the price to fall by approximately $5 per month to the level of ~$70 in December 2011. We also expect the price to slowly fall through 2016 and put the uncertainty bounds for the long-term trend in oil price. The level of oil price in 2016 is between $30 and $60 per barrel. These bounds are also shown in Figure 1.

10/3/11

Oil falls - attractive to buy

10/1/11

Time to buy oil futures. Again

9/28/11

Good time to sell oil futures

Figure 1 compares our prediction with actual oil price in 2011. In August 2011, the predicted price is a bit higher than the measured one. In any case, we expect the price to fall by approximately $5 per month to the level of ~$70 in December 2011. We also expect the price to slowly fall through 2016 and put the uncertainty bounds for the long-term trend in oil price. The level of oil price in 2016 is between $30 and $60 per barrel. These bounds are also shown in Figure 1.

9/22/11

Time to buy oil futures

9/5/11

Oil price in August

8/26/11

ConocoPhillips share price to fall

8/8/11

Oil price and deflation

6/16/11

The IEA projection for oil

For oil, the projections are based on prevailing futures prices, which form an assumption as opposed to a price forecast. The crude price assumption used in the outlook averages $103 per barrel, or around $20 more than in last year’s MTOGM.

We also presented a projection for oil price through 2016 which is based on the presence of a sustainable linear trend in the difference between the core and headline CPI in the USA. This price will be progressively decerasing to the level of $35 to $50 per barrel in 2016. It would be interesting to compare these prejections in, say, 3 years.

9/10/10

Does crude drive the price index of steel and iron?

9/4/10

Crude in 2010

1. Crude Oil And Motor Fuel: Fair Price Revisited

6/9/10

Does crude drive the price index of steel and iron?

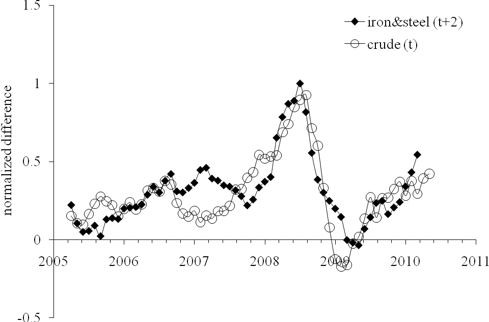

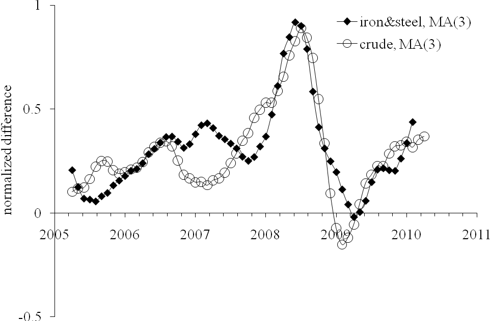

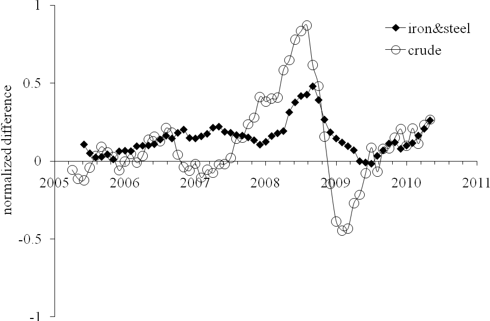

Figure 1. The deviation of the iron and steel price index and the index of crude oil from the PPI, normalized to the PPI.

6/6/10

Crude price in August 2010

A month ago we presented a forecast for oil price. It’s time to revisit the price. All our estimates are based on the existence of long-term sustainable trends in the differences between various subcategories of the producer price index (PPI). The concept and numerous forecasts is published in this paper. The dry residual is that the producer price indices evolve along straight lines, with all deviations from the trend cancelling themselves out over relatively short periods of several months.

Figure 1 present the case of crude petroleum (domestic production) for the period between 2007 and 2012. We have predicted that the difference between the overall PPI and the index for oil will be on a upward trend since 2009. This means than the PPI will grow faster than the index of oil, the latter likely to fall into 2016 down to the level of ~75.

In March and April 2010, the index of crude petroleum had a bigger deviation out of the trend in Figure 1. Therefore, the most likely next movement in the price will be the return to the trend. Moreover, the difference will likely to break the trend line and go into the other side for several months. This would mean the price of oil falling in May 2010 and during the summer months, as shown in Figure 1 by red circles. Tentatively, we put the index at the level between 160 and

Figure 1. The difference between the overall PPI and the index for crude petroleum. The new predicted trend is shown by dashed line. In May and likely in summer 2010, the index for oil will be decreasing. The difference will be growing as shown by red circles.

P.S. Apparently, oil price lost several dollars in May 2010, and one could say that this post is a bit late and just declares known facts. This is the Bureau of Labor Statistics who reports the PPI and its components in the middle of the next month. Our concept would fail to predict that this is exactly May 2010 when oil price should stop to grow. However, the currently observed level of price is not viable. The price must fall at some point, the larger is the deviation the faster and more violent is the recovery.

4/5/10

CRUDE OIL AND MOTOR FUEL: FAIR PRICE REVISITED

Ivan O. Kitov, Oleg I. Kitov

Institute for the Geospheres’ Dynamics, Russian Academy of Sciences

In April 2009, we introduced a model representing the evolution of motor fuel price (a subcategory of the consumer price index of transportation) relative to the overall CPI as a linear function of time. Under our framework, all price deviations from the linear trend are transient and the price must promptly return to the trend. Specifically, the model predicted that “the price for motor fuel in the US will also grow by 50% by the end of 2009. Oil price is expected to rise by ~50% as well, from its current value of ~$50 per barrel.” The behavior of actual price has shown that this prediction is accurate in both amplitude and trajectory shape. Hence, one can conclude that the concept of price decomposition into a short-term (oscillating) and long-term (linear trend) components is valid. According to the model, the price of motor fuel and crude oil will be falling to the level of $30 per barrel during the next 5 to 8 years.

Key words: CPI, PPI, crude oil, motor fuel, price, prediction, USA

JEL Classification: E31, E37

Introduction

In the beginning of 2009 we developed a model [1, 2] predicting the long-term price evolution for various subcategories of consumer and producer price indices as well as major commodities: gold, crude oil, metals, etc. The model was based on one prominent feature of the difference between consumer (producer) prices of individual components and the overall consumer (producer) price index. These differences are characterized by the presence of sustainable long-term (quasi-) linear trends. For many producer price indices, these trends are slightly nonlinear but still robust. They are observed in subcategories with varying weights in the CPI and PPI: meats [3], gold ores [4], durables and nondurables [5], jewelry and jewelry related products [6], and motor fuel [7].

The model

The model derived in [1, 2] implies that the difference between the overall CPI (same for the PPI), CPI (PPI), and a given individual price index iCPI (iPPI), can be described by a linear time function over time intervals of several years:

CPI(t) – iCPI(t) = A + Bt (1)

, where A and B are the regression coefficients, and t is the elapsed time. Therefore, the “distance” between the CPI and the studied index is a linear function of time, with a positive or negative slope B. Free term A compensates the difference related to the start levels for a given year. For example, the index of communication was started from the level of 100 in December 1997 when the overall CPI was already at the level of 161.8 (base period 1982-84 =100).

Figure 1. Illustration of linear trends. Left panel: the difference between the headline CPI and the index of motor fuel between 1980 and 2010. Right panel: The difference between the overall PPI and the (producer price) index of crude petroleum (domestic production). In both panels: there are two quasi-linear segments with a turning point near 2000. Since the end of 2008, both differences have been passing a transition. Linear trends with relevant linear regression lines and corresponding slopes are also shown.

Figure 1. Illustration of linear trends. Left panel: the difference between the headline CPI and the index of motor fuel between 1980 and 2010. Right panel: The difference between the overall PPI and the (producer price) index of crude petroleum (domestic production). In both panels: there are two quasi-linear segments with a turning point near 2000. Since the end of 2008, both differences have been passing a transition. Linear trends with relevant linear regression lines and corresponding slopes are also shown.From Figure 1 (and many others published before), one can conclude that the presence of linear trends is a basic feature of the CPI and PPI. Another fundamental characteristic of the differences consists in the fact that all deviations from the trends were only short-term ones. This implies that any current or future deviations from the new trends in Figure 1, which have been under development since 2008, must be compensated promptly. This feature allows short-term (months) price predictions.

Predicted vs. actual

Originally, we presented a model for the price evolution for motor fuel and crude oil from March to December 2009. For the motor fuel index, we drew a straight line shown in the left panel of Figure 2. This line said that motor fuel price would be growing faster than the price of all goods and services. Specifically, we predicted that:

In March 2009, the difference was at the level of +45, i.e. much higher than the level predicted by the new trend. As happened in the past with numerous individual price indices [9,10], such a strong deviation (one might call it “dynamic overshoot”) should be compensated in the near future. Without loss of generality, we have restricted the recovery to the trend by the end of 2009. As a result the index for motor fuel should growth by 90 units during the next 9 months, or by 10 units per month. Red filled circles represent the evolution of the difference from April to December 2009. In 2010, the difference may undergo an overshoot in the opposite direction with additional rise in the index for motor fuel.

Translating indices into prices, the rise in the difference by 90 units (from 173 in March to 263 in December) means an increase in price by 50%. Therefore, it is very likely that the price for motor fuel in the beginning of 2010 will be 60% to 70% larger than in March 2009 due to the overshoot.

We have been also tracking the evolution of crude oil price, which obviously affects the price index of motor fuel. As Figure 1 demonstrates, these prices have no one-to-one correspondence and it might be instructive to model them separately. So, for oil price we used an alternative approach and assumed that the price trajectory would continue the pendulum-like motion observed since 2008. This implied the difference between the PPI and the index of crude petroleum should sink below the new trend and stop at the level of -120, which roughly corresponds to $120 per barrel.

Figure 2. Left panel: The difference between the headline CPI and the index for motor fuel. Solid diamonds represent the prediction given in March 2009 through December 2009. The total increase in the difference is +60 units of index or +35%: from 173 in March to 233 in December. Dashed line represents the new trend, which is a mirror reflection to that between 2001 and 2008 shown by solid black line. Right panel: Evolution of the difference between the PPI and the index for crude petroleum (domestic production). Solid diamonds represent the predicted values between March and December 2009, as anticipated in April 2009 with a dynamic overshoot below the new trend. Open circles – the observed difference between September and December 2009. Dashed line represents the new trend as described in the text.

Figure 2. Left panel: The difference between the headline CPI and the index for motor fuel. Solid diamonds represent the prediction given in March 2009 through December 2009. The total increase in the difference is +60 units of index or +35%: from 173 in March to 233 in December. Dashed line represents the new trend, which is a mirror reflection to that between 2001 and 2008 shown by solid black line. Right panel: Evolution of the difference between the PPI and the index for crude petroleum (domestic production). Solid diamonds represent the predicted values between March and December 2009, as anticipated in April 2009 with a dynamic overshoot below the new trend. Open circles – the observed difference between September and December 2009. Dashed line represents the new trend as described in the text.From Figure 2, it is clear that the oil price differnce leads that of motor fuel by six to eight months. It is likely that the index of motor fuel will follow up the trajectory drawn by oil price and fluctuate around its trend with slightly larger amplitude. The predictive power of this assumption will be tested by the end of 2010. We are going to track and report on actual behavior. Our model needs further validation in both short- and long run.

Discussion

All in all, our prediction of the price index of motor fuel was based on a sound assumption and thus is accurate. The forces behind the observed long- and short-term behavior are not accessible yet but very powerful. We dare say they are fundamental and affect the economy to its deepest roots. These forces retain equilibrium among all economic agents and originate the sustainable trends in the differences between consumer (producer) price indices. At some point, the forces meet their limits and should be re-balanced in order not to harm the economy. As a result, the sustainable trends in the CPI and PPI turn.

Figure 3. The evolution of crude oil price. Solid line – oil price for the period between 2001 and 2010. Dashed line – the new developed trend between 2009 and 2016. According to the prediction, the price should fall to the level of $30 per barrel by 2016.

Figure 3. The evolution of crude oil price. Solid line – oil price for the period between 2001 and 2010. Dashed line – the new developed trend between 2009 and 2016. According to the prediction, the price should fall to the level of $30 per barrel by 2016.References

1. Kitov, I., Kitov, O. (2008). Long-Term Linear Trends In Consumer Price Indices, Journal of Applied Economic Sciences, Spiru Haret University, Faculty of Financial Management and Accounting Craiova, vol. III(2(4)_Summ), pp. 101-112.

2. Kitov, I., Kitov, O. (2009). Sustainable trends in producer price indices, Journal of Applied Research in Finance, vol. I(1(1)_ Summ), pp. 43-51.

3. Kitov, I., Kitov, O., (2009). Apples and oranges: relative growth rate of consumer price indices, MPRA Paper 13587, University Library of Munich, Germany

4. Kitov, I. (2009). Predicting gold ores price, MPRA Paper 15873, University Library of Munich, Germany

5. Kitov, I., Kitov, O. (2009). PPI of durable and nondurable goods: 1985-2016, MPRA Paper 15874, University Library of Munich, Germany,

6. Kitov, I. (2009). Predicting the price index for jewelry and jewelry products: 2009-2016, MPRA Paper 15875, University Library of Munich, Germany

7. Kitov, I., Kitov, O. (2009). A fair price for motor fuel in the United States, MPRA Paper 15039, University Library of Munich, Germany

8. Bureau of Labor Statistics. (2010). Databases, Tables & Calculators by Subject, retrieved 30.03.2010 from http://www.bls.gov/data/

9. Kitov, I. (2010). Deterministic mechanics of pricing. Saarbrucken, Germany, LAP Lambert Academic Publishing

9/25/09

Goldman Sachs on oil in 2009 and 2010

9/22/09

Share price of select energy companies. Part 2

Figure 12. Observed and 3-C predicted Halliburton share prices: HAL(t) = -3.66*EC(t-6) +2.42*CF(t+1) - 0.41*(t-2000) - 37, where EC is the index of education and communication and CF is the headline CPI less food. Standard deviation is $2.35.

Figure 12. Observed and 3-C predicted Halliburton share prices: HAL(t) = -3.66*EC(t-6) +2.42*CF(t+1) - 0.41*(t-2000) - 37, where EC is the index of education and communication and CF is the headline CPI less food. Standard deviation is $2.35. Figure 13. Observed and 3-C predicted Hess CP share prices: HES(t) = 0.61*E(t+1) + 4.1*RENT(t-7) – 26.4*(t-2000) - 865.7, where EC is the index of education and communication and CF is the headline CPI less food. Standard deviation is $5.92.

Figure 13. Observed and 3-C predicted Hess CP share prices: HES(t) = 0.61*E(t+1) + 4.1*RENT(t-7) – 26.4*(t-2000) - 865.7, where EC is the index of education and communication and CF is the headline CPI less food. Standard deviation is $5.92. Figure 14. Observed and 3-C predicted Massey Energy CP share prices: MEE(t) = 3.25*CSH(t+1) - 6.37*CFSHE(t-11) + 2.33*(t-2000) + 592.9, where CSH is the headline CPI less shelter and CFSHE is the headline CPI less food, shelter and energy. Standard deviation is $6.30.

Figure 14. Observed and 3-C predicted Massey Energy CP share prices: MEE(t) = 3.25*CSH(t+1) - 6.37*CFSHE(t-11) + 2.33*(t-2000) + 592.9, where CSH is the headline CPI less shelter and CFSHE is the headline CPI less food, shelter and energy. Standard deviation is $6.30. Figure 15. Observed and 3-C predicted Murphy Oil CP share prices: MUR(t) = 0.83*T(t+1) – 6.25*HFO(t) + 6.20*(t-2000) + 655.9, where T is the index of transportation and HFO is the index of household furnishing and operations. Standard deviation is $4.27.

Figure 15. Observed and 3-C predicted Murphy Oil CP share prices: MUR(t) = 0.83*T(t+1) – 6.25*HFO(t) + 6.20*(t-2000) + 655.9, where T is the index of transportation and HFO is the index of household furnishing and operations. Standard deviation is $4.27. Figure 16. Observed and 3-C predicted Noble Energy share prices: NBL(t) = 0.86*T(t+2) + 2.88*RENT(t-3) - 15.8*(t-2000) - 694.4, where T is the index of transportation and RENT is the index of rent. Standard deviation is $3.97.

Figure 16. Observed and 3-C predicted Noble Energy share prices: NBL(t) = 0.86*T(t+2) + 2.88*RENT(t-3) - 15.8*(t-2000) - 694.4, where T is the index of transportation and RENT is the index of rent. Standard deviation is $3.97. Figure 17. Observed and 3-C predicted National Oilwell Varco share prices: NOV(t) = 4.13*C(t+1) – 10.87*HFO(t+1) - 9.26*(t-2000) + 641.5, where C is the headline CPI and HFO is the index of household furnishing and operations. Standard deviation is $5.28.

Figure 17. Observed and 3-C predicted National Oilwell Varco share prices: NOV(t) = 4.13*C(t+1) – 10.87*HFO(t+1) - 9.26*(t-2000) + 641.5, where C is the headline CPI and HFO is the index of household furnishing and operations. Standard deviation is $5.28. Figure 18. Observed and 3-C predicted Occidental Petroleum share prices: OXY(t) = 0.73*T(t+1) + 1.17*MCS(t-5) - 12.36*(t-2000) - 405.5, where T is the index of transportation and MCS is the index of medical care services. Standard deviation is $3.25.

Figure 18. Observed and 3-C predicted Occidental Petroleum share prices: OXY(t) = 0.73*T(t+1) + 1.17*MCS(t-5) - 12.36*(t-2000) - 405.5, where T is the index of transportation and MCS is the index of medical care services. Standard deviation is $3.25. Figure 19. Observed and 3-C predicted Pioneer Natural Resources share prices: PXD(t) = - 3.24*EC(t-6) + 0.43*E(t+1) + 4.08*(t-2000) + 305.6, where EC is the index of education and communication and E is the index of energy. Standard deviation is $3.73.

Figure 19. Observed and 3-C predicted Pioneer Natural Resources share prices: PXD(t) = - 3.24*EC(t-6) + 0.43*E(t+1) + 4.08*(t-2000) + 305.6, where EC is the index of education and communication and E is the index of energy. Standard deviation is $3.73. Figure 20. Observed and 3-C predicted Rowan Companies share prices: RDC(t) = - 1.74*F(t-5) + 0.49*TPR(t+1) + 9.59*(t-2000) + 222.5, where F is the index of food and beverages and TPR is the index of private transportation. Standard deviation is $2.85.

Figure 20. Observed and 3-C predicted Rowan Companies share prices: RDC(t) = - 1.74*F(t-5) + 0.49*TPR(t+1) + 9.59*(t-2000) + 222.5, where F is the index of food and beverages and TPR is the index of private transportation. Standard deviation is $2.85. Figure 21. Observed and 3-C predicted Schlumberger share prices: SLB(t) = - 5.47*F(t-11) + 0.93*T(t+1) + 36.9*(t-2000) + 695.9, where F is the index of food and beverages and T is the index of transportation. Standard deviation is $7.24.

Figure 21. Observed and 3-C predicted Schlumberger share prices: SLB(t) = - 5.47*F(t-11) + 0.93*T(t+1) + 36.9*(t-2000) + 695.9, where F is the index of food and beverages and T is the index of transportation. Standard deviation is $7.24. Figure 22. Observed and 3-C predicted Sunoco share prices: SUN(t) = - 15.9*CO(t-8) + 10.17*HFO(t-8) - 19.8*(t-2000) + 257.7, where CO is the index of communication and HFO is the index of household furnishing and operations. Standard deviation is $6.12.

Figure 22. Observed and 3-C predicted Sunoco share prices: SUN(t) = - 15.9*CO(t-8) + 10.17*HFO(t-8) - 19.8*(t-2000) + 257.7, where CO is the index of communication and HFO is the index of household furnishing and operations. Standard deviation is $6.12. Figure 23. Observed and 3-C predicted Tesoro share prices: TSO(t) = -2.85*F(t+2) - 5.44*FB(t-11) + 54.4*(t-2000) + 1273, where F is the index of food and beverages and FB is the index of food only. Standard deviation is $6.12.

Figure 23. Observed and 3-C predicted Tesoro share prices: TSO(t) = -2.85*F(t+2) - 5.44*FB(t-11) + 54.4*(t-2000) + 1273, where F is the index of food and beverages and FB is the index of food only. Standard deviation is $6.12. Figure 24. Observed and 3-C predicted XTO Energy share prices: XTO(t) = 1.49*CSH(t+2) – 1.73*FB(t-6) + 9.87*(t-2000) + 18.1, where CSH is the headline CPI less shelter and FB is the index of food only. Standard deviation is $3.29.

Figure 24. Observed and 3-C predicted XTO Energy share prices: XTO(t) = 1.49*CSH(t+2) – 1.73*FB(t-6) + 9.87*(t-2000) + 18.1, where CSH is the headline CPI less shelter and FB is the index of food only. Standard deviation is $3.29.Сенатор Круз - США разрешат Израилю бомбить любую страну. Иначе он и его единоверцы не попадут в рай

В США у власти находятся по-настоящему верующие люди. В интервью Такеру Карлсону сенатор США Тед Круз подробно объяснял причины поддержки Из...

-

These are two biggest parts of the Former Soviet Union. To characterize them from the economic point of view we borrow data from the Tot...

-

These days sanctions and retaliation is a hot topic. The first round is over and we will likely observe escalation well supported by po...

-

This paper "Gender income disparity in the USA: analysis and dynamic modelling" is also of interest Abstract We analyze and deve...