Volume V of the Journal of Applied Economic Sciences has been issued. I am proud to co-author one of the papers.

Alessio Emanuele BIONDO, Growth Rate for a Sustainable Economy … 7

Maria BOBROVA, Arndt KÜMPEL, Reasoning on Evolution of Culture and Structure

… 21

A.B. BONACHE, J. MAURICE, K. MORIS, A Best Evidence Synthesis on the Link between Budgetary Participation and Managerial Performance … 34

Ginters BUSS, Forecasts with Single-Equation Markov-Switching Model: An Application to the Gross Domestic Product of Latvia … 48

Lisi GAETANO, The Unemployment Volatility Puzzle: The Role of the Underground Economy … 59

Giuseppe GAROFALO, Patrizio MIRGANTI, The Financing of R&D Investments: Effects on Growth and Financial Structure … 70

Ivan O. KITOV, Oleg I. KITOV, Dynamics of Unemployment and Inflation in Western Europe: Solution by the 1-D Boundary Elements Method … 94

Abstract

Using an analog of the boundary elements method in engineering and science, we analyze and model unemployment rate in Austria, Italy, the Netherlands, Sweden, Switzerland, and the United States as a function of inflation and the change in labor force. Originally, the model linking unemployment to inflation and labor force was developed and successfully tested for Austria, Canada, France, Germany, Japan, and the United States. Autoregressive properties of neither of these variables are used to predict their evolution. In this sense, the model is a self-consistent and completely deterministic one without any stochastic component (external shocks) except that associated with measurement errors and changes in measurement units. Nevertheless, the model explains between ~65% and ~95% of the variability in unemployment and inflation. For Italy, the rate of unemployment is predicted at a time horizon of nine (!) years with pseudo out-of-sample root-mean-square forecasting error of 0.55% for the period between 1973 and 2006. One can expect that the unemployment will be growing since 2008 and will reach ~11.4% [0.6 %] near 2012. After 2012, unemployment in Italy will start to descend.

Evgenia MOTCHENKOVA, Daniel LELIEFELD, Adverse Effects of Corporate Leniency Programs in View of Industry Asymmetry … 114

Rajesh K. PILLANIA, Indo-China Trade: Trends, Composition and Future … 129

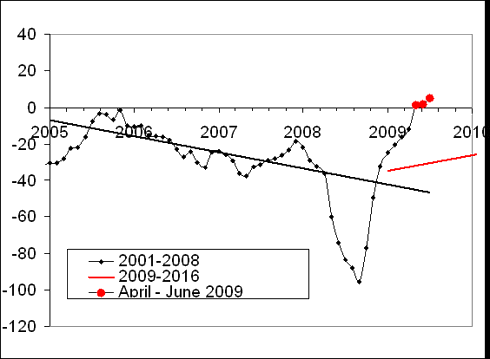

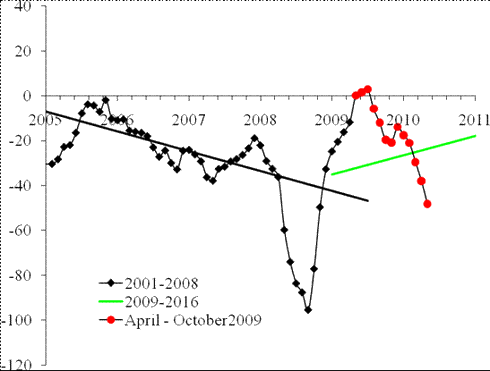

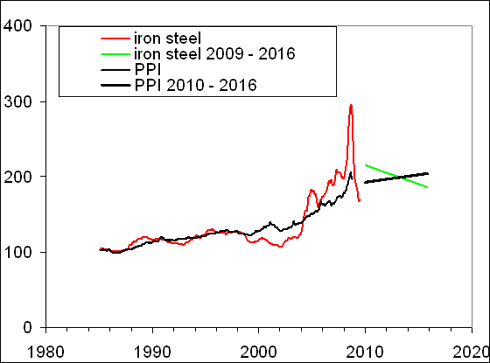

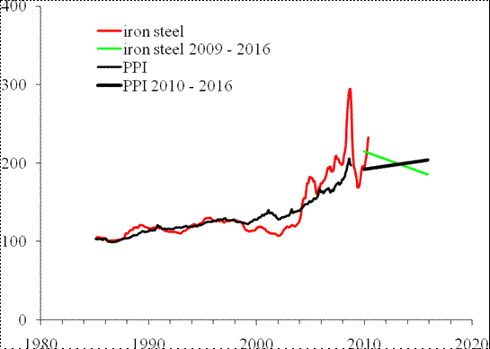

Georg QUAAS, Was the Worldwide Asymmetry in Current Accounts Caused by the Macroeconomic Policy of the Global Economy’s Leader? … 138