7/29/10

Procter and Gamble on rise?

7/28/10

PepsiCo share price

IBM share price on decline

7/27/10

Xilinx share price

References

Kitov, I. (2010). Deterministic mechanics of pricing. Saarbrucken, Germany, LAP Lambert Academic Publishing.

Ball Corporation share price

Schlumberger share price

7/26/10

Solow on economics as a science

HPQ share price

So, the best-fit 2-C model for HPQ(t) is as follows:

HPG(t) = -3.20FB(t-4) +2.91RPR(t-5) + 3.64(t-2000) - 50.82

Figure 1. Evolution of the price of DAIRY and TPU.

Figure 2. Observed and predicted HPQ share prices. Original prediction is shown by red line. Black diamonds present the original line shifted 4 months ahead, i.e. the model.

Figure 3. Residual error of the model. Mean residual error is 0 with standard deviation of $2.13. The largest errors were observed in 2007.

References

Kitov, I. (2010). Deterministic mechanics of pricing. Saarbrucken, Germany, LAP Lambert Academic Publishing.

MMM share price

So, the best-fit 2-C model for MMM(t) is as follows:

MMM(t) = -0.74DAIRY(t-10) – 0.54TPUP(t-6) + 8.70(t-2000) + 180.88

The model does predict the share price in the past and foresee a significant fall in the last quarter of 2010, i.e. through December 2010. It will be in line with the overall fall in the S&P 500 in 2010.

Figure 1. Evolution of the price of DAIRY and TPU.

Figure 2. Observed and predicted MMM share prices. Original prediction is shown by red line. Black diamonds present the original line shifted 6 months ahead.

Figure 3. Residual error of the model. Mean residual error is 0 with standard deviation of $3.79. The largest errors were observed in 2005 and 2006.

References

Kitov, I. (2010). Deterministic mechanics of pricing. Saarbrucken, Germany, LAP Lambert Academic Publishing.

7/25/10

Predicting DeVry's share price

According to [1], the model for DeVry (DV) is defined by the index for the rent of primary residency (RPR-CUUS0000SEHA) and that of pets, pet products and services (PETS-CUUR0000SERB). The former CPI component leads the share price by 11 months and the latter one leads by 4 months. Figure 1 depicts the overall evolution of both involved indices. From our past experience, the larger is the lag the more unreliable is the model. However, both defining components provide the best fit model between August 2009 and June 2010. The positive influence of RPR (+7.90) is compensated by the negative input of all other terms . So, the best-fit 2-C model for DV(t) is as follows:

DV(t) =7 .90RPR(t-11) – 2.76PETS(t-4) - 35.73(t-2000) - 757.63

The predicted curve in Figure 2 leads the observed price by 4 months with the residual error of $3.24 for the period between July 2003 and June

The model does predict the share price in the past and foresees A significant fall in the next quarter, i.e. through September 2010. It will be in line with the overall fall in the S&P 500 in 2010.

Figure 1. Evolution of the price of RPR and PETS.

Figure 2. Observed and predicted DV share prices . Original predcition is shown by red line. Black diamonds present the original prediction shifted by 4 months ahead.

Prediction of Legg Mason share price

According to [1], the model for Legg Mason (LM) is defined by the index of food (F-CUUS0000SAF ) and that of appliances (APL-CUUR0000SEHK). The former CPI component leads the share price by 4 months and the latter one leads by 13 months. From our past experience, the larger is the lag the more unreliable is the model. However, both defining components provide the best fit model between August 2009 and June 2010. Both coefficients in the LM model are positive. This means that increasing food price forces the share price up. The fall in the index of appliances has been compensating *see Figure 1) both the increase in F and positive linear time trend in the share price, as defined by the slope of +33.024. So, the best-fit 2-C model for LM(t) is as follows:

LM(t) =

The predicted curve in Figure 2 leads the observed price by 4 months with the residual error of $6.89 for the period between July 2003 and June

The model does predict the share price in the past and foresees no significant increase in the next quarter, in July through September 2010. Considering the overall fall in the S&P 500 in 2010, one should not expect any growth in stock prices at all.

Figure 1. Evolution of the price index of food (F) and appliances (APL).The latter has been falling since July 2009.

Figure 1. Evolution of the price index of food (F) and appliances (APL).The latter has been falling since July 2009.

Figure 2. Observed and predicted LM share prices.

Figure 3. Residual error of the model. Mean residual error is 0 with standard deviation of $6.89. the largest errors were observed in 2005 and 2006.

References

Kitov,

7/24/10

Apple share price. Revision, July 2010

Two months ago we presented a model and made a conservative prediction on AAPL share price. The model for AAPL(t), as introduced in [1], was as following

AAPL(t)= 19.03HFO(t-13) - 10.13HOS(t) + 73.86(t-1990) – 1862.5

where the index of housing furnishing and operations (HFO) leads AAPL(t) by 13 months. The index of housekeeping supplies (HOS) is synchronized with the price.

We also suggested that the price would be not growing at the same pace as in the beginning of 2010. Conditional on the decline in HOS, which was expected in April-July 2010, the share price might decline since May 2010. Figure 1 demonstrates that the actual price has been decreasing since May and this behaviour was well described by the model. One might expect that AAPL share will be falling together with S&P 500 into 2011.

Figure 1. Observed and predicted AAPL share prices.

References

Kitov,

Mechanics of Inflation and Unemployment

We have compiled a draft version of Section 2.1 of Chapter 2 titled "Mechanics of Inflation and Unemployment". The interested reader may find Section 2.1 in pdf format here.

The contents:

2.1. Inflation, unemployment and labour force in the uSA

2.1.1. The (anti-) Phillips curve

2.1.2. Is labour force driving?

2.1.3. The model and data improvement

2.1.4. Forecasting inflation

2.1.5. Discussion

7/23/10

Mechanics of Gross Domestic Product

7/10/10

Deflation is approaching US

How close to deflation are we?

Interstingly, five years ago we calculated that a deflationary period should start in 2012 and publsihed this forecast in 2006: Exact prediction of inflation in the USA.

Below is Figure 9 from this paper. ALl predcitions between 2006 and 2009 were almost absolutely correct. So, inflation has not come yet, but will visit the US soon.

Figure 9. Predicted inflation rate for the period between 2006 and 2016.

Several months ago we presented the same graph with actual inflation readings in this blog:Sure - disinflation continues

7/6/10

First issue of Theoretical and Practical Research in Economic Field

The first issue of TPREF (the whole journal as a pdf file ) is available now. I am an author of one article and a co-editor.

Contents: 1 | The Nexus Between Regional Growth and Technology Adoption: A Case for Club-Convergence? Stilianos Alexiadis University of Piraeus …4 | 7 | A Survey on Labor Markets Imperfections in Mexico Using a Stochastic Frontier Juan M. Villa Inter-American Development Bank … 97 |

2 | Can Shift to a Funded Pension System Affect National Saving? The Case of Iceland Mariangela Bonasia University of Naples Oreste Napolitano University of Naples … 12 | ||

3 | Global Supply Chains and the Great Trade Collapse: Guilty or Casualty? Hubert Escaith World Trade Organization … 27 | ||

4 | Some Empirical Evidence of the Euro Area Monetary Policy Antonio Forte University of Bari … 42 | ||

5 | Modeling Share Prices of Banks and Bankrupts Ivan O. Kitov Institute for the Geospheres‟ Dynamics, Russian Academy of Sciences … 59 | ||

6 | Infrastructures and Economic Performance: A Critical Comparison Across Four Approaches Gianpiero Torrisi Newcastle University … 86 | ||

7/5/10

Unemployment In Germany

Approximately a year ago we predicted the rate of unemployment, UE, in Germany at the level of 11% in 2011. This prediction was obtained from the following model linking unemployment and labor force, LF:

UE(t) = 3.2dLF(t-5)/LF(t-5) + 0.08 (1),

where the change in labor force leads the unemployment by 5 (!) years. A comprehensive discussion of the model and data, as retrieved from OECD database, is given in [1].

For this study, we borrowed unemployment estimates from the DEStatis (Federal Statistics Office). They are slightly different from those provided by the OECD, and are issued at a monthly rate.

This is time to revise the prediction and estimates. Figure 1 presents the measured and predicted unemployment rate for the period between 2002 and 2012. All in all, both curves are very close, except the most recent period.

Because of the discrepancy, we have checked the DEStatis for corroborative data on labor force and found new estimates for 2006 through 2009, which are related to national concept. When (1) is applied, one obtains the open triangle curve with the new estimates.

We still consider the level of 11% in 2011 as a reliable estimate. From 2001 to 2009 relationship (1) worked well with the estimates of labor force from the OECD.

However, there is a possibility that the new estimates of labor force are not too bad, and actual unemployment in 2011 will not be above 10%. In 2010 the rate will reach the level between 8% and 9%.

This is a good example that one can predict the future evolution of macroeconomic variables, but the past is unpredcitable. It is a common feature when statistical agencies revise their past estimates.

Figure 2. Observed and predicted rate of unemployment in Germany.

7/2/10

Second half of 2010 - second wave of crisis

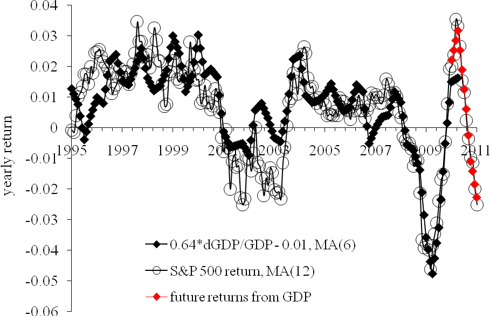

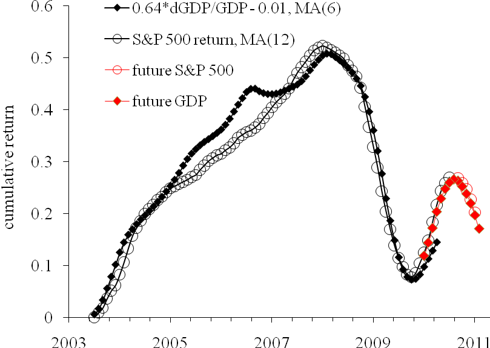

Rp(t) = 0.0062dlnG(t) - 0.01,

2009Q4: 7% (5.6%)

2010Q1: 6% (2.6%)

2010Q2: +2%

2010Q3: -2%

2010Q4: -3%

7/1/10

S&P 500 in July 2010

The original model links the S&P 500 annual returns, Rp(t), to the number of nine-year-olds, N9. To obtain a prediction we use the number of three-year-olds, N3, as a proxy to N9 at a six-year horizon:

Rp(t+6) = 100dlnN3(t) - 0.23

where Rp(t+6)is the S&P 500 return at a six-year horizon. Because of the properties of the N3 distribution one can replace it with linear trends for the period between 2008 and 2011, as Figure 1 shows. The model shown in Figure 1 predicts that the S&P 500 stock market index will be gradually decreasing at an average rate of 37 points per month. (Correction from the previous post where 46 points per months was used by mistake.) In June, actual closing level was 1030 (-60 relative to May 2010). This level is about 90 points below that predicted in Figure 1. This is the continuation of the May’s panic. Such dynamic "overshoot" in the beginning of a new trend is a common feature.

Figure 1. Observed S&P 500 monthly close level and the trend predicted from the number of nine-year-olds. The slope is of -37 points per month. The same but positive slope was observed between February 2009 and April 2010.

Figure 1. Observed S&P 500 monthly close level and the trend predicted from the number of nine-year-olds. The slope is of -37 points per month. The same but positive slope was observed between February 2009 and April 2010. The deviation from the new trend is a big one and one can expect the end of panic in July/August 2010. This is a nice feature of the trend. Any deviation, whatever amplitude it has, must return to the trend. So, by the past experience we may judge that 90 points should be compensated quickly. This means that the level of S&P 500 should not change much in July and August 2010. We would expect the close level between 1020 and 1050 in July 2010.

Then, the index will continue gradual decrease into 2011. Figure 2 demonstrates that the S&P 500 annual return will sink below zero in the third-fourth quarter of 2010.

Figure 2. Observed and predicted S&P 500 returns.

Figure 2. Observed and predicted S&P 500 returns. -

These are two biggest parts of the Former Soviet Union. To characterize them from the economic point of view we borrow data from the Tot...

-

These days sanctions and retaliation is a hot topic. The first round is over and we will likely observe escalation well supported by po...

-

This paper "Gender income disparity in the USA: analysis and dynamic modelling" is also of interest Abstract We analyze and deve...