The Chinese ballon was likely a meteorological one with corresponding devices. If shot down above land, the debris would prove this assumption and it would be an aggressive act against a scientific device although lost its path. It was shot above water in order to be able to claim that the remnants were not found. There will be no proof that it was a spy device or a scientific one. Saves the face.

2/5/23

После некоторого порога участия экс солдат НАТО и наемников с оружием НАТО на стороне на Украине война перейдет в войну против НАТО. Россия сможет создать открытую анти-натовскую коалиция

НАТО разрушила много городов и населенных пунктов и убила миллионы людей по всему миру в 21-м веке (и еще больше в 20-м веке). Есть много стран и людей, разгневанных и готовых сражаться с НАТО, если только можно создать равные условия. Украина привлекает много солдат и граждан из стран НАТО (и присоединившихся к ней). Как только в мире придут к выводу, что на Украине воюет НАТО (доля экс натовских солдат и наемников процентов 30-40%) и Россия, добровольцы и некоторые страны создадут анти-натовскую коалиции и приедут мстить. Они получат все необходимое оборудование и возможности мести. И это не будет борьба против Украины, а только против НАТО (Запада). Линии снабжения НАТО не выдержат.

2/4/23

Russian plan is simple - involve as many NATO soldiers in Ukraine as possible and create an anti-NATO coalition to annihilate them.

NATO has done a lot of destruction and killed millions of people in the world in the 21st century (and more in the 20s century). There are many countries and people angry and ready to fight against NATO in an equal fight. Ukraine attracts a lot of soldiers and citizens from NATO (and affiliated) countries. Volunteers from the anti-NATO coalition will come to get revenge and will be given all the needed equipment and opportunities. And this will not be a fight against Ukraine or NATO (the West).

Personal income inequality has been increasing in the USA since 2010

Personal income is the American dream - the measure of success. The success histories have been fading away together with the dream - more and more people moving toward the bottom of the personal income distribution. Figure 1 shows the Gini ratio which is the most famous integral measure of income inequality. This graph is retrieved from the CPS data sets published by the US Census Bureau. One important notice on this graph is that the Gini ratio in the Census Bureau definition does not include people not reporting any income during the previous year during the (March) Annual Social and Economic Supplement of the Current Population Survey (ASEC CPS). In 2021, there were 268,723,000 people 16+ and only 237,500,000 of them reported income (~12%). This contradicts the most comprehensive definition of the Gini ratio as related to the whole society. (The income inequality in the USA would be too large if the non-incomers are counted in.) Even with people with incomes, the Gini ratio is extremely large in 2021 - 0.527. This is especially weird if to take into account the helicopter money injected in 2020 and 2021. In 2007, the Gini ratio was 0.494.

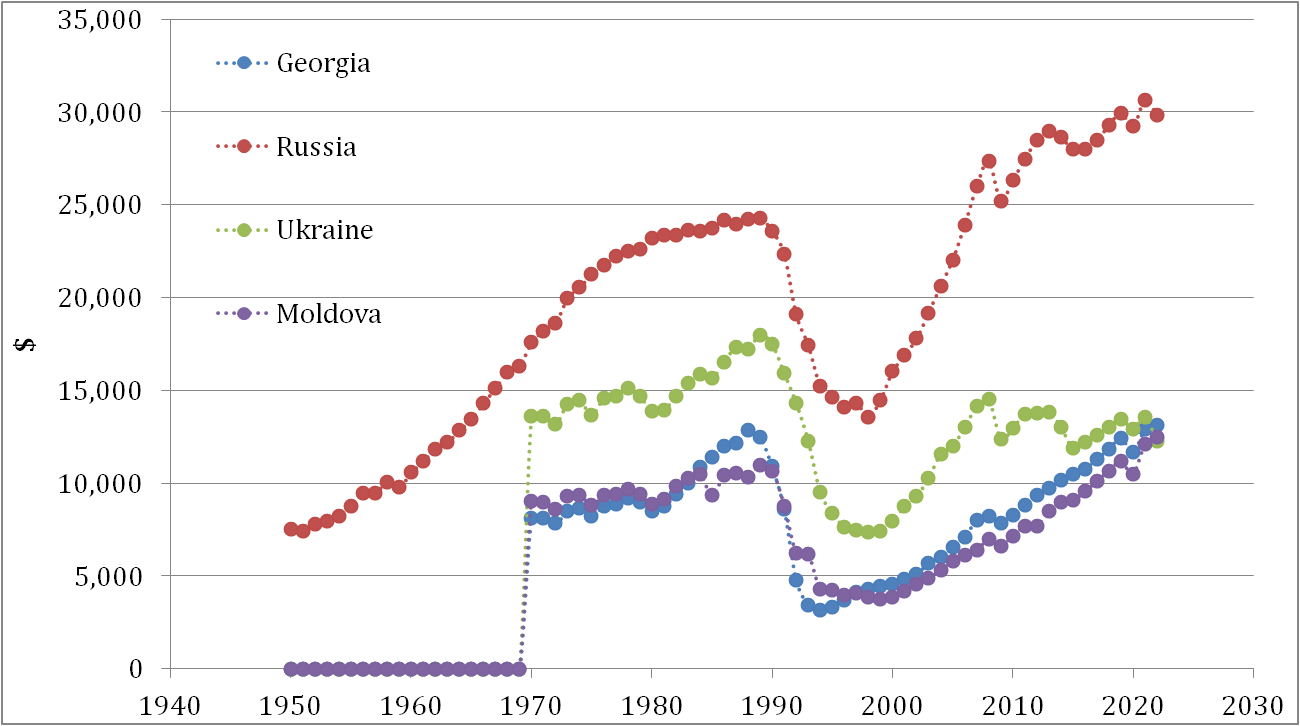

Real GDP per capita: Ukraine, Georgia, and Moldova. Ukraine below the 1970 level - lost half-century.

The real GDP per capita is a good measure of the country's prosperity and the shape of the economy. It also may indicate the direction of future evolution. The figure below is borrowed from "The Conference Board Total Economy Database™ - Output, Labor and Labor Productivity, 1950-2022. April 2022." This might be not the most reliable source of data, but all other sources give similar results.

Ukraine is a failed economy with a current GDP per capita level below that in 1970. The lost half-century. Georgia and Moldova overcame the 1970s in the 2010s, but are still at the level of 1988.

the us does not shoot the Chinese balloon because it is actually a meteorological one

2/2/23

The excess personal income from the helicopter money is equal to the total growth in consumer prices from 2020 to 2022

In our previous post, we presented arguments in favor of a long deflationary period in the USA starting in 2023. There was one estimate to be clarified in order to better understand the connection between the total gain in the consumer price index in 2020 and 2021 and the helicopter money injected into the US economy during the same period. As we estimated, the CPI increased from approximately ~260 in 2020 (before the start of the inflation growth period) to ~295 in 2022 (before the end of the inflationary period). A crude estimate of the total price increase during the inflationary period gives 15%. In 2021, fifteen percent of the nominal GDP makes approximately 3 trillion US dollars. The amount of helicopter money injected into the US economy between 2020Q2 and 2021Q3 can be estimated as the excess of personal income, PI, during the same period relative to the average PI share between 2012 and 2019 which is 86%. The helicopter money excess is 2.9 trillion. This money is likely the source of price inflation, and the most likely the only source of inflation.

2/1/23

Deflation is the next challenge for the USA

In December 2022, a deflationary period started in the USA. Formally, both the PPI (Final Demand) and CPI fell. In absolute values, the PPI fell from 140.721 in November to 139.544 in December, or by 1.18. When annualized, the PPI fell in December by 14.12 (12 months times 1.177) or by 10%. Figure 1 shows the evolution of the monthly (annualized) PPI between Dec. 2011 and Dec. 2022.

Figure 1. Annualized monthly dPPI/PPI from 2011 to 2022. In December

2022, the rate of fall was 10%.

In absolute values, the CPI fell from 298.349 in November to 298.112 in

December, or by 0.237. When annualized, the CPI fell in December by 2.84 (12

months times 0.237) or by 1.0%. Figure 2

shows the evolution of the monthly (annualized) CPI between Dec. 2011 and Dec.

2022.

Figure 2. Annualized monthly dCPI/CPI from 2011 to 2022. In December 2022, the rate of fall was 1.0%.

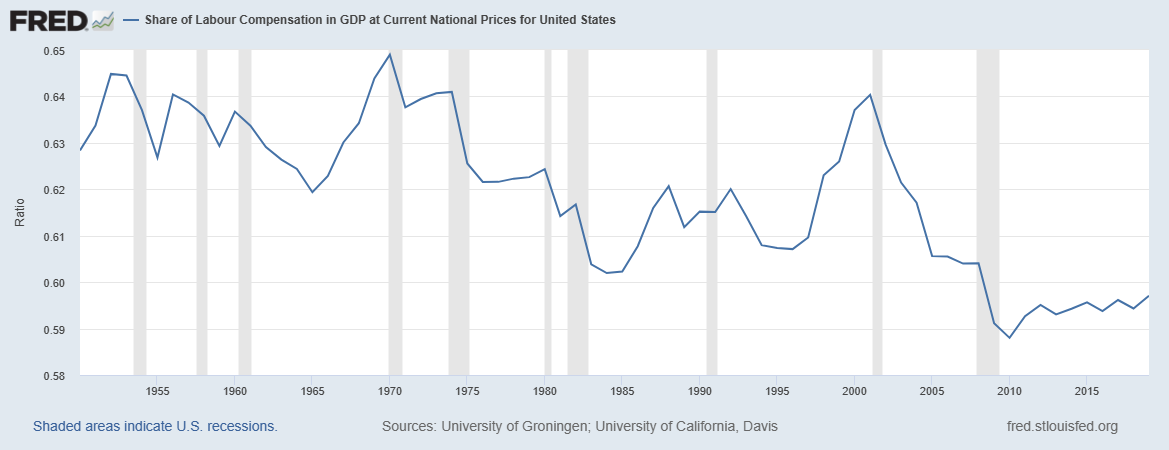

The inflation period observed in the USA after the helicopter money was poured into the US economy in 2020 is quite different from all natural (related to labor force growth/shrinkage) inflation observed ever before. Figure 3 demonstrates that the money was transferred to people without any economic reason and the Personal Income in 2020Q2 was 104% of the nominal GDP with a long-term ratio of 87%. This money activated processes of spending and consumer price inflation in the earlier 2021, i.e. approximately 1.25 years after the money was added. This was not a normal way inflation works but rather a one-timer. The prices jumped repeating the money-added curve and the effect of the ballooned PI in Figure 2 is the jump in prices. When the effect of the helicopter money faded away with the PI/GDP ratio sunk below the long-term trend at the end of 2021 no other price increase is possible. With a 1.25-year delay between the money injection and the CPI reaction, consumer prices have to fall. And this process started in December 2022.

Figure 3. The ratio of the quarterly personal income, PI, and nominal

GDP (both as estimated by the BEA) and the evolution of CPI in the USA.

The observed CPI and PPI inflation rates (around 6%) are still high and

it may cause some doubts at the start of a deflationary period. The high

CPI/PPI estimates are the effect of the price jump many months ago. Figure 4

depicts the monthly CPI increment, dCPI. The largest monthly increment, 3.85, was

observed in June 2022. It will affect the rate of inflation till June 2023 when

this reading will not be counted in anymore. And the next increment in July

2022 was below 0. Then inflation will become negative on an annual basis. Before

July 2023, the annual rate of inflation will gradually drop to 0, but the

monthly inflation rate estimates will be all negative.

The deflation period will last longer than the current high inflation

period. The reason is simple – the consumer and producer prices in December

2022 were at a much higher level than in January 2020: CPI by 15% and PPI (FD) -

17%. There is no money in the PI to match the new level of consumer and

produced demand as expressed in new dollars, as Figure 3 shows. To print more (a

few trillions of dollars) money is not as easy no as in 2020 as the debt

ceiling is a big political issue before the 2024 elections. The total price

fall will be larger than the growth by 15% -17% because price deflation is

a self-promoting process.

Figure 4. Monthly CPI increment, dCPI.

The deflation period will last longer than the current high inflation period. The reason is simple – the consumer and producer prices in December 2022 were at a much higher level than in January 2020: CPI by 15% and PPI (FD) - by 17%. There is no money in the PI to match the new level of consumer and produced demand as expressed in new dollars, as Figure 3 shows. To print more (a few trillions of dollars) money is not as easy no as in 2020 as the debt ceiling is a big political issue before the 2024 elections. The total price fall will be larger than the growth by 15% -17% because price deflation is a self-promoting process.

-

These are two biggest parts of the Former Soviet Union. To characterize them from the economic point of view we borrow data from the Tot...

-

These days sanctions and retaliation is a hot topic. The first round is over and we will likely observe escalation well supported by po...

-

This paper "Gender income disparity in the USA: analysis and dynamic modelling" is also of interest Abstract We analyze and deve...