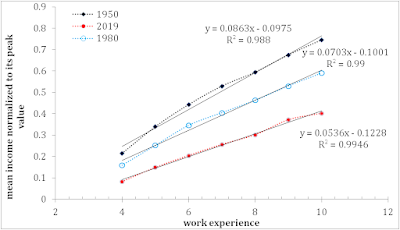

The 1950s and 1960s were the years of U.S. prosperity as many people think. This was the middle-class era. People recall it with nostalgia. Let's take a look at the reasons behind the optimism of the 1950s. Figure 1 below shows the evolution of the mean income with age. The age bins for the mean income estimates are 1 year of work experience and the data are obtained from IPUMS. We compare the years of 1950, 1990, and 2019. To compare data from different years we normalized all estimates to the peak mean income for a given year (Figure 2 displays the normalized mean income evolution in 1950, 1980, and 1990). As a result, we observe in the figure the relative mean income growth with age experience (starting at the age of 16).

One can see that in 1950 people with 10 years of work experience had 75% of the peak income. In 1990, this share dropped below 60%. In 2019, the mean income with 10 years of work experience was just above half of that in 1950 - 40%. Therefore, the rate of income growth has a long-term decline in the younger age group where people create families and raise children. It was easy in the 1950s and 1960s. And it is almost impossible in the 2020s for a majority of the U.S. population. Unfortunately, the peak age for the mean income increases as a square root of the real GDP per capita. The future of U.S. society is defined by income growth - the chance for young people to create families and raise children will diminish with real economic growth. The visible prosperity of the 1950s will never return.